It took six months to overhaul the previous record, but the US investment-grade corporate bond market has seen its new biggest deal of the year. A $30 billion 10-tranche monster from pharmaceutical company AbbVie, issued to help finance its $63 billion acquisition of Allergan, raced through the market on November 13.

| ALSO IN THIS STORY |

| Why investors piled into AbbVie’s issue |

It was the fourth-biggest US dollar investment-grade corporate deal in history and pulled in $76.2 billion of demand at its peak.

Before AbbVie’s issue, the biggest deals of 2019 had been a pair of trades on consecutive days in May. Bristol-Myers Squibb sold $19 billion on May 7 before IBM trumped that with $20 billion on May 8.

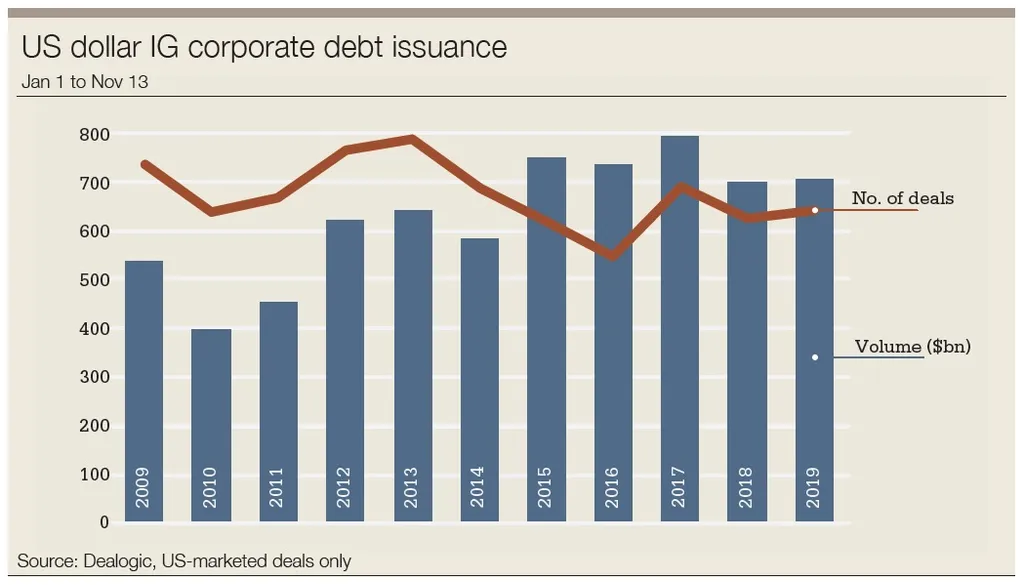

The AbbVie bond took total volume in US-marketed dollar investment-grade corporate bonds for the year to November 13 to a smidgen above the same point in 2018, although it remained behind the 2015 to 2017 period.

Including issuance from financial names, dollar investment-grade issuance stood at about $1.1 trillion for the year to November 13, which is down a few percent from the same period in 2018. And net issuance, factoring in maturities, is probably down between 5% and 10%, according to bankers, as liability management combined with waning corporate appetite for jumbo M&A deals to reduce supply.

Accounting for over 40% of all US-marketed dollar DCM, the investment-grade sector is an important contributor to the fee pool for banks. DCM was the standout business line for most of the big global investment banks in their recent third-quarter earnings announcements and nearly all cited investment-grade issuance as a key driver.

And while no one is expecting volumes to fall off a cliff, a market less boosted by big M&A financings will hurt investors by taking away what are typically the best performing transactions.

|

|

|

Andrew Karp, BofA Securities |

Some of the decline in gross supply is offset by an increase in euro and sterling issuance from US names, as Andrew Karp, head of global investment-grade capital markets at BofA Securities, notes.

“The overall supply in the market is basically the same but has shifted,” he says. “You have seen a lot more trades going into the reverse Yankee arena as clients issue in euros; and so that reduced supply has benefited secondary levels in the dollar market.”

Those that have been invested this year have seen excellent performance. Year-to-date returns in investment-grade dollar debt were over 13% by the end of the third quarter.

Unsurprisingly, that has helped drive demand through the year; investors seeing good returns elsewhere tend to chase them.

“Demand is exceptional for investment-grade credit,” says Marc Fratepietro, Deutsche Bank’s US-based global co-head of DCM. “It is in a sweet spot for many investors right now. Rates and equity volatility, which are proxies for risk, are both falling.”

This year has seen 14 consecutive weeks of net flows into dollar investment-grade credit, he adds, with some $96 billion of net inflows compared with about $69 billion at the same point last year. And that’s just what is visible: it doesn’t account for foreign interest and doesn’t capture a lot of pension fund buying.

Weaker M&A pipeline

Part of that demand story, however, reflects a supply dynamic that ought to leave investors more concerned. Fratepietro is not alone in noting that AbbVie has flattered the statistics slightly and he points out that corporates are broadly not as predisposed to taking on large amounts of leverage at this point in the cycle.

More importantly, big M&A financings – one of the key drivers for supply in the last 18 months – are looking thinner on the ground.

No one knows when financing backing the $26.5 billion merger of T-Mobile and Sprint might come – if it comes at all, given that the deal is subject to a lawsuit that will kick off in December.

Broadcom is another possible candidate, if it looks to refinance the term loans with which it financed its $10.7 billion purchase of Symantec this year. But those are not bridges, so there is no guarantee of a take-out.

|

|

|

Barbara Mariniello, Barclays |

The merger of Mylan and Pfizer’s Upjohn division could provide another, but the reality is that the visible pipeline of $10 billion-plus deals is at a low ebb.

“It feels like the M&A financing pipeline is lighter at this point than in years past, which I think has been one of the most notable drivers of demand for the jumbo financings that have come to market,” says Barbara Mariniello, head of Americas DCM at Barclays.

“Traditionally you would get through one jumbo deal and another would be announced almost immediately – at this point in another year you might have had visibility on another $100 billion. This time there seems to be more of a sense among investors of ‘it’s now or never’, so they are all the more keen to participate when one comes.”

That’s something that bankers say helped AbbVie, which pulled in a book of about $76 billion before being trimmed as initial pricing thoughts tightened roughly 25 basis points across the deal into final guidance.

“In general, investors continue to show a preference for the larger, liquid transactions, and in instances where transactions are very visible, folks have already allocated capital to participate in those,” adds Karp.

|

|

Now, however, AbbVie has come at a time when not only is jumbo M&A less visible but, at the time of writing, the Thanksgiving shutdown was just two weeks away. That gave a further fillip to the deal and was in contrast to the IBM and Bristol-Myers deals in May, which came when the calendar was expected to be busy.

Those deals got away, but while demand was strong for Bristol-Myers, it was not as good for IBM, which came the following day and then widened in secondary.

“The market probably digested AbbVie a bit better than those, but central bank action and the lighter M&A pipeline have certainly helped now,” says one banker.

Deals like AbbVie are also much favoured by a buy side looking for near-guaranteed performance. Chunky M&A financings are often priced to go, and from an investor standpoint it is much easier to secure upside from one $30 billion trade than it is from 30 $1 billion bonds.

Central bank drivers

Central bank activity on both sides of the Atlantic has been vying with M&A financing as the biggest driver of investment-grade volumes.

“The big theme that encapsulates the year is that central banks are back in our neighbourhood,” says Peter Burger, head of US syndicate at HSBC. “It has utterly turned on itself. This time last year conditions were predicated on the Federal Reserve raising rates, but with it signalling early this year that it was not going to continue with rate rises, and now having cut and signalling lower for longer, the effect on the credit market has been very supportive.”

|

|

|

Peter Burger, HSBC |

That dynamic played out in stages, as Burger explains. The first ‘Powell Put’, as market participants like to call those moments when Fed chairman Jerome Powell indicates a willingness to provide stimulus, came in January with publication of the minutes from the Fed’s December meeting in which it said it would stop raising rates. But coming after a year of the opposite approach, it was tough for the market to absorb.

A Fed meeting in March, which confirmed the new thinking, helped to solidify acceptance that policy was changing and came at a time when similar indications from other central banks gave more momentum to the notion that there could be a broad-based central bank-supported rally.

The June meeting – at which the Fed finally cut rates for the first time since 2008 – was the icing on the cake.

“The Fed was saying we are going to make this rally continue, and that’s when we saw global investors really start to participate,” says Burger.

Since then the Fed has cut twice more.

“Central bank actions have clearly been very supportive of investment-grade credit, particularly by helping to bring down long-term rates,” adds Fratepietro, who notes that the US market has a bigger long-duration element to it than most others.

At the same time, the European Central Bank has recently provided its own driver for demand. In September it said it would restart its purchase of securities – some €20 billion a month – from November, “for as long as necessary to reinforce the accommodative impact of policy rates”.

“The big theme that encapsulates the year is that central banks are back in our neighbourhood” – Peter Burger, HSBC

Among the effects of the ECB’s action are a further squeeze on dollar supply on one hand, alongside stimulating demand for dollars on the other.

It makes the euro-denominated market ever more receptive to new names, helping to bolster the interest in reverse-yankee issuance that had already been seen repeatedly this year. Harley-Davidson and Colgate Palmolive are among those to have brought reverse-yankee debuts in the last month or so, while Apple issued its first euro green bond.

In certain sectors, such as healthcare, issuers have also been tendering for dollar debt and issuing in euros, adding a double squeeze on dollar supply.

“More companies are splitting their issuance across currencies,” adds Mariniello at Barclays. “In the past you would often see US companies think about it but then often just issue all dollars anyway. Now companies are seeing what they can do in euros and using dollars to get the rest of what they need.”

Another effect of the ECB’s move – albeit with a slight lag, say bankers – is that it further encourages the flight of money held by traditional euro investors to dollar debt.

“The ECB buying new issues means that regular investors are getting cut back, but it also means that some of that money may trickle over to dollars,” says Mariniello.

In a world of $16 trillion of negative yielding debt, it will not take much for investors to take that further inducement. And DCM bankers say that more and more of that money entering the dollar market is now unhedged, aiming to capture a higher yield.

“That negative yielding debt is forcing investors to do things that investors would normally not do, and that includes taking some currency risk,” says one.

Yield-chasing?

On the face of it, AbbVie’s deal might appear to illustrate the typical yield-chasing dynamic of low-rate environments.

But while Baa2/BBB+ rated AbbVie certainly sits on a low rung of the investment-grade ladder, some bankers said that investors would have been playing the M&A deleveraging story more than anything. And it’s worth noting that top-rated credits have not struggled to attract attention, such as the well-received $7 billion bond from triple-A rated Exxon Mobil in August.

“It’s not the case that investors are just jumping down the credit spectrum for yield,” says Mariniello. “We continue to see strong demand for triple-A issuers.”

Others argue that recently investors have both the confidence and the need to increase risk.

“Generally speaking, the initial money was into less risky single A, but over the past couple of months the fact that the US economy is not falling off a cliff has given a lot of support for people to go down the credit curve,” says Burger, who adds that there has been particular interest from foreign investors to do so.

|

|

|

Marc Fratepietro, Deutsche Bank |

According to Fratepietro, investors are proving unafraid of BBB-risk even at this late stage of the cycle, so long as they are being paid for it. “They will be a bit more idiosyncratic with these credits, but for the right name at the right price, there is very good demand,” he says.

That is reflected in the compression of the spread between the triple-B and single-A sectors, for example, which bankers reckon might have moved from perhaps 125-150 basis points a year ago, to something closer to 75bp today.

Even less debatable is that investors have been willing to move out along the maturity curve wherever possible. “Demand being skewed to the long end is a theme we have observed throughout the year,” says Karp, and that duly played out in AbbVie’s deal.

Bankers say that investors drove out to longer maturities quickly this year and have continued to do so. “As we go into December, some people are saying that they have had a heck of a year and are judiciously monetizing those holdings,” adds Burger. “But AbbVie shows that people are certainly not running away from the 30-year.”

Others agree. “The long end of the curve, from 10s to 30s, continues to be the deepest part of the market – and that’s true of investor demand and also interest from issuers,” says Fratepietro.

One reason is the structural demand for long-dated paper that exists from pension funds and insurance companies. For obvious reasons, that long money is less rate sensitive and more duration sensitive.

But there is an equally strong driver on the issuer side. In the past, when 10-year rates have been at levels seen today, the curve has always been steeper. On a relative basis that means that today’s long end is much more attractive to an issuer than usual, given the smaller concession needed to pull in long money.

|

|

As Fratepietro explains, companies looking at liability management have noticed. “If you are going to go through the whole process of tendering and exchanging, then you want to get a lot of bang for your buck,” he says.

More technical reasons than greed and fear have also played into some of the tenor dynamics. The planned end of Libor at the end of 2021 meant that demand for three- to five-year floating rate paper evaporated earlier this year, although two-year bonds withstood that.

“Next year you’ll see a move from the two-year to 18-months and then to the one-year,” adds Burger. “The good thing is that it has given the front end of the market a good credit bid.”

The bit that has suffered at times is the five-year area, traditionally the deepest part of the curve along with 10s, with bankers saying that investors have this year been wary of being caught in the belly of the curve. A reversion to a more normal treasury curve has mitigated this a little.

For a while recently the fives were a low point, but now that there is a positive slope from twos to fives, things are looking a little more conventional.

Uncertain outlook

What then for 2020? With a presidential election due that year, issuance is expected to be more front-loaded than usual. And given the stage of the cycle, economically sensitive sectors are expected to be under relatively more pressure.

What is evident is that prospects may be less favourable. In 2018 and through the first half of 2019, the dollar investment-grade market was mostly an M&A financing story. AbbVie aside, the second half of 2019 has been much more of a refinancing and liability management market.

Sadly for investors, the second half of 2019 is likely to presage the situation in 2020, say bankers. Sadly because M&A financings are the easiest way for a portfolio manager to put large blocks of cash to work.

It helps that the market typically knows they are coming, meaning that spreads adjust to reflect supply, giving a further boost to performance. Without such issues, easy pick-ups will be few and far between.

“Investors will face the proverbial question of whether all the excess return juice has already been squeezed out,” says Fratepietro. “At some point they have to ask that question, but because of the amount of cash they have, they have to stay invested.”

| Why investors piled into AbbVie’s issue |

|

AbbVie, which brought a 10-tranche $30 billion bond in November to help finance its acquisition of Allergan, could be the last big dollar corporate bond backing an M&A trade for a while. And investors duly piled in. The deal had three floating-rate portions at the short end, with 1.5-year, two-year and three-year notes of $750 million, $1.75 billion and $3 billion, respectively. The remaining seven fixed-rate tranches were twos, threes, fives, sevens, 10s, 20s and 30s. On the back of investor meetings a week earlier, the book got off to a good start on November 13 and built solidly through the trade. Investors were well set up for it, say bankers, and positioned to participate across the curve. “These big deals are getting a bit more efficient each time,” says one senior DCM banker. “After a lot of investor calls, there was a decent-sized shadow order book heading into the trade.”

And so it proved, with pricing able to be tightened throughout the structure to the extent that some bankers reckoned the borrower achieved a negative new issue premium of some 5-10 basis points. “I think one of the striking things about these kinds of deals now is the aggressive approach of investors with respect to price – there were zero or negative new-issue premiums across the tranches,” says one banker. “The lack of supply away from the deal exacerbated the market appetite for it, and so people got comfortable that they could buy at more aggressive levels.” While that looks impressive on the face of it – and there is no debate that AbbVie went well – bankers also caution that the market is generally well positioned for such trades in advance, meaning that secondary spreads at the time of pricing tend to have adjusted for the expected supply. Demand and issuance was skewed to the long end of the curve, which bankers said reflected the continuing buy-side grab for yield. There was about $15 billion of demand for the 30-year tranche alone and double digit billions in every tranche from the sevens onwards. “Demand was clearly weighted towards the 20s and 30s, with about 40% to 50% of demand coming in those tranches,” says one banker. Participation from visible non-US demand (in other words, not sought through third-party money managers) was particularly pronounced across the deal, bankers said. AbbVie was flexible on structure, but with its glut of tranches hitting every part of the curve, it was able to get the size and tenors that it wanted, say bankers. Tightening during the bookbuild didn’t extract all the secondary juice, however, with the 20-year tightening about 8bp the following day and the 10-year trading about 4bp tighter on November 15. The two previous biggest deals this year – a $19 billion trade from Bristol-Myers on May 7 and a $20 billion deal from IBM the following day – saw contrasting receptions. The book was about 25% to 30% larger on Bristol-Myers than IBM, reaching about $64 billion, says one banker who worked on both deals. And while Bristol-Myers tightened in the immediate aftermarket, IBM widened. That point in the year was of course a choppier time in the market, coming out of a difficult fourth quarter of 2018, and investors were still getting to grips with Fed policy. And bankers note that a name like IBM tends to be a tighter credit, leaving less room on the table for outperformance. |

That’s a common refrain among those working on the deal, with many acknowledging that by now issues like these have become routine. “The approach was not ground-breaking,” says another. “At this size and with so many maturities, it was casting the net wide.”

That’s a common refrain among those working on the deal, with many acknowledging that by now issues like these have become routine. “The approach was not ground-breaking,” says another. “At this size and with so many maturities, it was casting the net wide.”