Most of the corporate and investment banking (CIB) earnings commentary from banks this quarter was on their markets businesses, rather than debt and equity capital markets (DCM and ECM).

The latter were mostly a little weaker than the previous year. Pipelines were often seen as more muted heading into the second half of the year, partly for seasonal reasons but also on fewer acquisition-financing opportunities as well as continuing concerns over trade. However, the changing rate environment was seen as potentially spurring new issuance in DCM.

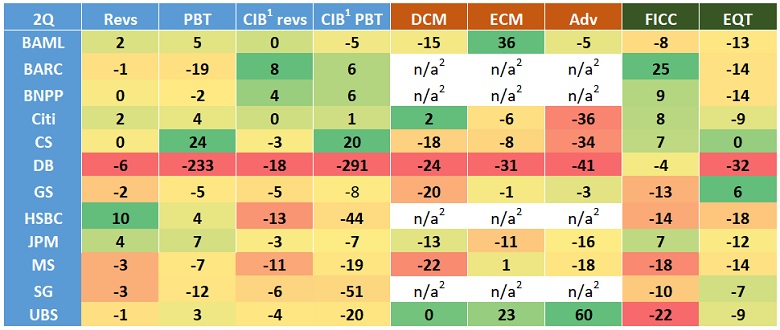

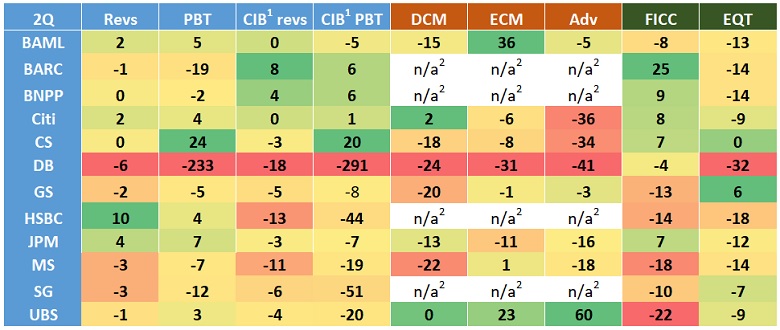

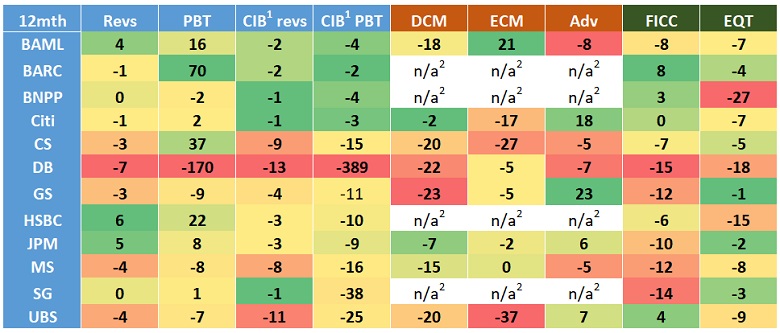

Investment bank quarterly heatmaps

numbers are percentage change for 2Q19 vs 2Q18 and for latest 12-month period vs previous period

1 CIB is ICS+IB at GS, IS at MS, GB+GM at BAML, CIB at JPM, ICG at Citi, CIB at DB, CIB at BARC, IB at UBS, GBM at HSBC, GMIS+F&A at SG, CIB-related at CS, CIB at BNPP

2 BARC, BNPP, SG and HSBC do not break out...

Thanks for your interest in Euromoney!

To unlock this article, enter your e-mail to log in or enquire about access: