|

|

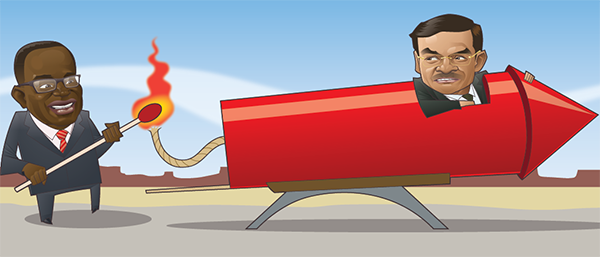

Illustration: Kevin February |

Oh, to have been a fly on the wall when Credit Suisse CEO Tidjane Thiam told his Asia Pacific chief, Helman Sitohang, about the bank’s new targets for Asia. At a time when China is slowing, the commodity price cycle has damaged regional growth, Japan is stagnant and uncertainty pervades everything from US interest rates to the fate of the EU, Sitohang was asked to more than double pre-tax income by the end of 2018.

Thanks for your interest in Euromoney!

To unlock this article: