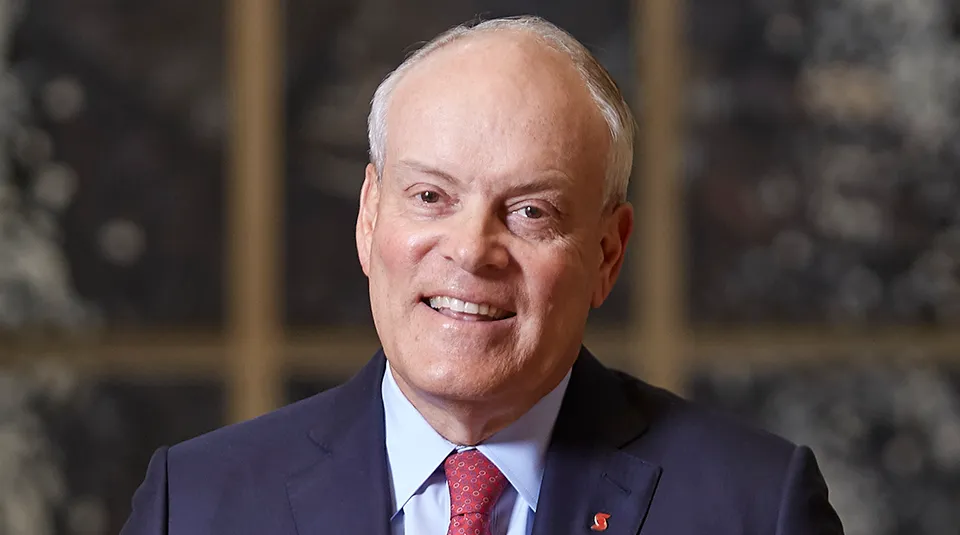

Celebrating its 190th anniversary this year, making it older than the confederation of Canada itself, Scotiabank has quite a heritage. So does Brian Porter, its chief executive, who has been at the firm for his whole career, stretching back to 1981. But when he took the helm in 2013, his job was to reposition a bank that might best have been described as a mini-HSBC.

Now the bank looks very different and is emerging robustly from the coronavirus pandemic. For the solid execution of its transformation strategy, coupled with strong performance in its home market and the effective deployment of new digital solutions, Scotiabank is Canada’s best bank in 2022.

“We were in more than 50 countries around the world,” Porter tells Euromoney. “We had been profitable throughout the global financial crisis and didn’t have to raise equity, but with the post-crisis regulatory changes, we had to take a good hard look at our businesses and decide where we would prioritize our capital allocation.”

That meant some big moves. Over the years Porter has exited more than 20 countries and sold 15 businesses. He focused on building areas such as wealth management and invested heavily in technology. Geographically, the emphasis shifted to the bank’s extensive Latin American network.

“We have a unique footprint – we are a hemisphere bank,” he says. “People might ask: ‘Why are you in Chile?’ We are there because Canadian mining companies are there, Canadian pension funds are there. The same goes for Mexico – there are 160 Canadian companies operating there, and they need a bank.”

These are not vanity projects, and they are becoming all the more relevant as the bank’s Canadian clients opt to near-shore operations from Asia to countries such as Mexico in a bid to secure cheaper energy, a cheaper but skilled labour force and less stretched supply chains.

But Canada is still its backyard and Porter is optimistic there. The bank’s credit card business has been building well, as has auto finance, in which the bank is the market leader in Canada. Revenues in the bank’s Canadian business are up about 10% in the last 12 months.

The Canadian consumer is in good shape despite the pandemic, Porter argues. Nationwide, loan balances are down 3% since before Covid, while deposits and investible assets are up 13%, and Porter sees strong pent-up demand for banking services over the next couple of years.

He says it is a similar story with corporate and commercial clients too.

“When I talk to CEOs and CFOs, they say they are thinking of expanding, perhaps buying a business in the US,” he says. “I don’t see clients pulling back at all.”

And while he is careful not to be over-bullish, given the resource-heavy nature of the Canadian economy and many of the countries in which the bank operates, Porter says Scotiabank should benefit well from an environment of rising commodities prices.

We had to take a good hard look at our businesses and decide where we would prioritize our capital allocation

Brian Porter

Much of the client focus of late has centred on digitalization. ScotiaRED, introduced in September, is a suite of trading tools that uses artificial intelligence and other analytics to improve execution in equities, fixed income and FX.

A partnership with Google Cloud, announced around the same time, deepens the bank’s cloud-first commitment and is bringing an enhanced service to customers across the bank’s entire organization. And teaming up in December with Intuit Partnership – the platform behind names like QuickBooks, Credit Karma and Mailchimp – allows Scotiabank to offer its Canadian customers ways of sharing their banking data.

Porter speaks with passion about the firm’s commitment to playing a role in the economic and social fabric of the country. He concedes he has been fortunate that his predecessors also saw this as important, but he is relieved that shareholders have moved on over the last decade from seeing corporate and social responsibility as nothing but a drain on profitability.

He likes the fact that the bank made a 20-year commitment to sponsor the Scotiabank Arena down the road from the bank’s Toronto office.

Some still wonder why he signed up to that in 2018, but he doesn’t find it too hard to explain. Around 60% of Canadians claim to be fans of the Toronto Maple Leaf ice hockey team and the arena is the third-busiest facility of its kind in North America. As with so much of Scotiabank’s business, it is about being where the action is.