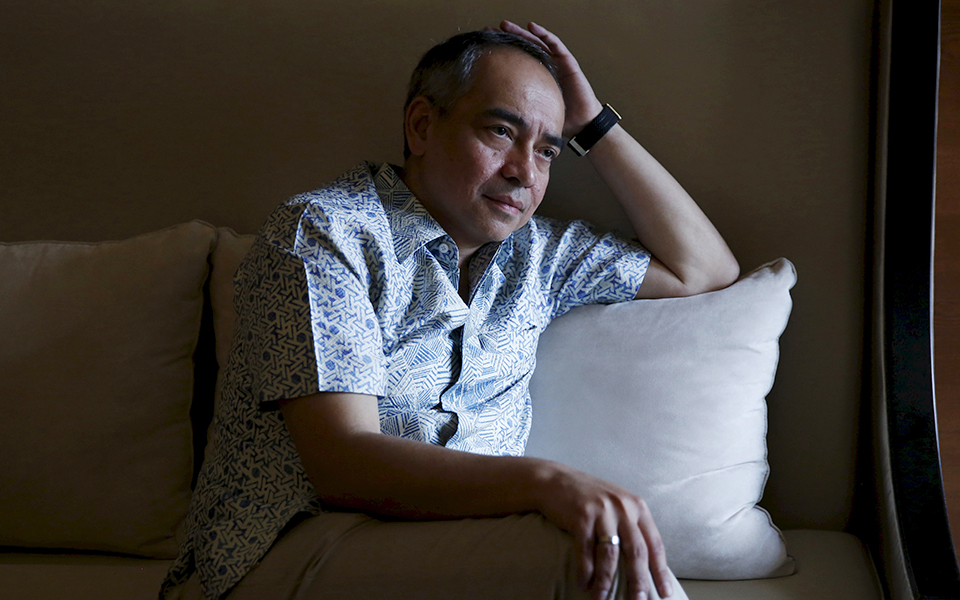

Podcast: Nazir Razak – what’s in a name?

You couldn’t have had a closer ring-side seat to the political and financial evolution of Malaysia than Nazir Razak did without actually being part of the action. Which, increasingly, he was.

Son of Malaysia’s second prime minister Abdul Razak, brother of its fifth, Najib, against whom he ended up in direct opposition over the 1MDB scandal, along the way Nazir built one of southeast Asia’s most powerful banks out of extremely modest foundations.

It has been quite a journey, and Nazir (given the number of Razaks in this story, and the Malaysian custom, we will go by first names) has now immortalized it in a book, ‘What’s in a name’.

It is going to rattle some cages, particularly in the family; among other things it makes clear the increasingly fractious relationship that Nazir, the youngest of five, and his other brothers had with Najib as they realized just how much their eldest-sibling-and-prime-minister knew about the devastating 1MDB scandal.

Jump to:

But that name, Razak, starts with Abdul. The book is “in part a journey for me to discover the father that I lost when I was very young,” Nazir tells Euromoney on a video call from Kuala Lumpur.

Nazir was nine when his father died, far away in a London clinic.

“He was a huge part of my life, not just in terms of my childhood because he was a towering figure in Malaysia. So, I have to begin there.”

One senses that, given everything that happened to the family name when Najib lost power and was sentenced to 12 years’ imprisonment, Nazir is keen to put his father’s legacy in the proper context.

Abdul – Nazir refers to him in the honorific form, Tun Abdul, which he doesn’t tend to use for anybody else – was a vastly important figure for a young country, his memory perhaps overshadowed by the sheer length of time his successor, Mahathir Mohamad, spent in the top job.

Abdul was the nation’s second prime minister, coming to power amid race riots; he stewarded a post-colonial nation trying to leave behind the British Empire and to forge a path of its own; he formed the Barisan National coalition that ruled for half a century; and, as a reformer he set, among other things, the foundation of the national education system.

“He spearheaded the transformational national reset in 1970,” Nazir says today. “We had the British system, and he reset it. And in many respects, that system he put in place in 1970 remains largely the underpinning of today’s system.”

Hindsight

The book is reverent as a proud son is bound to be to a father he didn’t get much time with, but Nazir is also careful not to be blinkered.

“Many of the policies, programmes and institutions my father helped to set up are in need of a fundamental overhaul,” he writes. The policies designed to improve the lot of the Bumiputra, or ethnic Malays, with preferential treatment come in for particular examination.

“With the benefit of ample hindsight, not all of his decisions were right… One of the lessons of his career is that you can only make decisions in the imperfect context you find yourself in.”

1MDB eventually led me to a choice I long wanted to avoid: between standing up for my father’s reputation and being loyal to my brother

But what does resonate is Abdul’s sense of duty and process, and it is easy to see why Nazir would want to re-associate those things with his family after several years when they were the absolute last thing one would apply to Najib.

Nazir writes about how Abdul wouldn’t accept toothpaste if it had been bought with government petty cash. By contrast, years later, Najib’s wife Rosmah would become famous for the 500 handbags seized by police amid accusations of plundered state coffers.

“Contrary to what people have suggested, when he passed away, he really did not leave so much for us,” Nazir tells me. “But he did leave a fantastic name for us to live with.”

The value of that name is clearly articulated in the book.

“As my career unfolded, I became ever more aware of the growing conflict between my father’s values and what had befallen the system he created,” he writes. “The obligations and values which come with my family name explain why I could not let go of the 1MDB affair; it touched everything that mattered to me, the standing of my family, my company and my country.

“1MDB eventually led me to a choice I long wanted to avoid: between standing up for my father’s reputation and being loyal to my brother.”

Recollection

All of that was some time in the future when Nazir became employee number 69 at a modest merchant bank called CIMB in 1989. At the time, he writes, the entire workforce could have fitted on a squash court.

Nazir’s recollection of his early days, under the book-hurling workaholic stewardship of notorious hard-arse corporate financer Steve Wong, is amusing and rather charming.

The Razak name didn’t count for anything in banking, and he worked his way up, making his name by being part of the drive to evolve the place from a seventh-ranked Barings-style corporate finance house to broader investment banking.

One of the best stories comes after CIMB won a mandate to work on the Tenaga Nasional IPO in 1991, a transformational mandate for the bank. He recalls one morning when he was on the phone to a travel agent, personally booking flights and hotels for the Tenaga management and their spouses, then jumping on a call with Salomon Brothers to discuss valuation metrics for the company, then going to Sungei Wang Plaza shopping centre in his suit to hand out retail application forms for shares to passing shoppers.

They were, he writes, “making things up as we went along”.

But Nazir had turned down offers from bigger names to take this job, and here was part of the reason.

I joined this can-do organization where I thought I could make a difference. And we worked extremely hard

“I joined this can-do organization where I thought I could make a difference,” he says. “And we worked extremely hard. You know, sometimes I joke that I don’t really like hiring people who worked in global banks, because they don’t know how to build. They just fall into a system. We had to learn everything.”

Nazir had picked a good moment to enter the profession in Malaysia. Tenaga was the vanguard of a new era in the markets, which had previously been, as he puts it, “nanny capital markets”, where the government dictated everything, right down to fees. Money was piling into the tiger economies, and for a time they were making money hand over fist.

Still, it was sometimes frontier-spirited verging on lawless; Nazir uses the word “shady” many times in the book, and the tone of the time is represented by an anecdote when a loan officer went to see a CIMB Securities client about an overdue payment. The client lifted his trouser leg to reveal a pistol tied around his ankle. The banker departed and asked for a pay rise.

“So much money was piling into these economies,” Nazir says now. “And unfortunately, regulation struggled to keep up. You know, that animal spirit really got into everyone, because if you were being an animal, you could make a ton of money. But if you’re being an animal, you’re going to forget rules.”

Asian boom

Malaysia was no different from any other market in the region at the time, he says; it was the boom that was found out by the Asian financial crisis. In his book he calls it “the coming together of two toxic cultures,” being the greed of developed market investors, and the money politics and corruption on the ground in Asia.

“The Asian Financial Crisis resembled a motorway crash involving a large number of cars moving at high speed, bumper to bumper in dense fog,” he writes. “The lesson I took from all this was that you didn’t have to go with the herd.”

He became chief executive in June 1999 aged just 32, and he now admits that the animal spirits were not doing particularly nice things for his nature. He recalls with guilt berating a senior manager from the loan-recovery department one evening, only to be reminded that it was 9.30pm on Christmas Eve and she was at Mass.

“I was reeling from my beginnings, when I had a real tough-driving boss,” he says now, speaking of Wong.

Nazir remains a big admirer of many things about Wong, though says he went overboard in his drive, and that Nazir had not intended to do the same.

The Asian Financial Crisis resembled a motorway crash involving a large number of cars moving at high speed, bumper to bumper in dense fog

“But then I got caught into it, and we were running very fast, doing M&A after M&A, and I went overboard myself for a while. You know, I still apologise to her today.”

Nazir wonders if his behaviour around that time, neglecting balance and health, came back to bite him when he was diagnosed with cancer a few years ago. The only release he really had in those years was playing squash, but his accounts of games with Tony Fernandes, the AirAsia CEO, during that time make it sound more like all-out warfare than relaxation.

It was, he writes, “like something from the Hunger Games”.

Still, when I ask if he would have been able to exercise the same risk appetite had he taken over at an older age, he instantly replies: “100% I wouldn’t be able to. I was young, I was in a hurry. I was much braver then.”

He knew enough to surround himself with grey hair – predecessor CEO Robert Cheim as adviser, and Wee Beng Gan as chief risk officer, for example – “but still, I made the ultimate decisions.”

Drive

I first met Nazir around this time, I think in 2002, in an interview for Euromoney’s sister publication Asiamoney, having heard of this dynamic young man who was going to reinvent Malaysian banking.

The article never appeared because I got pneumonia on the trip and ended up in hospital in Hong Kong under close surveillance because everybody thought I had SARS, but that’s another story.

What I do recall is that despite his impeccable manners and small frame, he had a great deal of drive, and that would be most clearly expressed in a series of steadily more ambitious acquisitions.

In the years ahead CIMB would turn regional by buying GK Goh in 2005, become a universal bank by buying BCB and Southern in 2006, and would buy assets around the region, including Indonesia’s Bank Niaga and, finally, RBS’s Asia assets in 2012. He then sold half the international brokerage business to China Galaxy in 2017.

I bought into that whole Asean story in terms of free movement of people and capital, and most of it didn’t come through

They were very different deals with very different outcomes. In the book, Nazir calls the GK Goh deal the most pleasant he ever did; BCB and Southern were ambitious and domestically game-changing; Niaga was challenging; and RBS he openly describes as “a failure” which “left a sour taste”.

What did he learn through all these acquisitions?

“That execution is paramount,” he says.

Also, that in-country mergers are easier, and cross-border synergies are tougher and can be undermined by an unexpected change in policy.

Some of this is a question of cultural fit. He tells the story of launching a product called octo in Indonesia, only to find it’s a term of abuse there and nobody at Niaga had bothered to tell him.

“Malaysia, Indonesia, we think like we’re all Malays and the same ethnicity, but culturally, they’re very different places to work. And the Philippines, as some people say, is a Latin American country in the wrong place. You’ve really got to understand the local culture and the nuances.”

RBS, on paper a good deal with assets priced at 80 cents on the dollar, was “a hard lesson”, he says, and the book makes clear how he thought the staff in Sydney in particular were self-interested and unwilling to roll up their sleeves to get things done.

But the bigger challenge was that Nazir’s whole-hearted belief in the idea of what Asean could be was never reciprocated.

“You know, I bought into that whole Asean story in terms of free movement of people and capital, and most of it didn’t come through,” he says. “And that left us with this Asean platform without the kind of free flow that it was meant to hugely benefit from.”

Today, asked if Asean failed to deliver on its potential, he replies: “100%.”

So much of the freedom he hoped for never materialized in any practically actionable sense.

“It’s a shame, because we as a region really need to integrate, to bring the 650 million population to bear on business and economic development.”

Events in Europe suggest global momentum is away from these blocs rather than towards them.

Suspicions

Nazir says he first heard of 1MDB, or the bond transactions that would kick off the whole saga, some time in 2009 when Lee Kok Kwan, CIMB’s then-head of debt markets and a long-time lieutenant throughout Nazir’s career, charged into the office to talk about a bond from some entity called Terengganu Investment Authority.

The 1MDB story is fabulously complicated but this is where the whole matter really starts, and Nazir says that it stank from the word go.

“We saw that the pricing and the manner in which the deal was distributed was quite clearly flawed,” Nazir says now. “We could do a back-of-the-envelope calculation and realize that a few hundred million ringgit was kind of given up on 1MDB. And where the money went, I had no idea. But from that point on I was very suspicious about what was going on there.”

Given how dramatically 1MDB would affect Nazir and his family, it is interesting to read how the nature of his objection changed over time.

First, he was worried that the integrity of the ringgit bond market was going to be damaged. Then, he was concerned that a government-linked company was being abused. And at this stage, he thought he was protecting his elder brother.

“I wasn’t trying to denounce him, still less to bring him down, but rather to save him from people around him, who – I assumed – were abusing the trust he had placed in them.”

I wasn’t trying to denounce Najib, still less to bring him down, but rather to save him from people around him, who – I assumed – were abusing the trust he had placed in them

Chief among them was of course Jho Low, who started to register in Nazir’s consciousness around 2013 when stories began to reach him, through Tony Fernandes initially, of this previously unknown man who was partying his way across the world.

Lakshmi Mittal phoned Fernandes one day to say he was sitting in an exclusive restaurant in St Tropez next to a Malaysian guy who had just spent almost $1 million on lunch. It was Jho Low. Before long, this apparent court jester was bringing along Psy of Gangnam Style fame to sing at Najib’s rallies in Penang.

Low was able to achieve the level of influence that he did because of flaws in the whole nature of Malaysian government.

“The concentration of power in the office of the PM, which had started during the Mahathir era, was near absolute,” Nazir writes. “So, whenever the PM chose, or allowed it, a close confidant could also become extremely powerful. Rasputin-like figures in the court of the PM had become a regular feature of Malaysian politics; Jho Low would take that to a whole new level.”

But the hardest part of the book reflects Nazir’s realization that Najib wasn’t just being misled and abused by Jho Low and others but appeared to know more about 1MDB than any of them had realized.

Nazir recounts numerous occasions when he, often with his three other brothers, tried to stage interventions with Najib, and would find him willing to listen and apparently alarmed; then Nazir would find reprisals coming his way afterwards.

First Nazir was told off for querying the CEO of Ambank, the Malaysian bank most closely involved in the deal. After he spoke to KPMG, 1MDB’s auditors, KPMG were immediately fired for breaching client confidentiality.

And after Nazir wrote an article ‘Remembering my father’ as a none-too-subtle shot across his brother’s bows to remind him of their family values, and later wrote a joint statement with his other brothers protecting their father’s name, Nazir and his wife and children were subjected to a defamatory social media campaign that, Nazir maintains, threatened the safety of his children, then at boarding school in the UK.

Threats

By 2015, with more and more material appearing in The Edge, The Wall Street Journal and The Sarawak Report, the stakes were escalating. Nazir says he lobbied Malaysia’s rulers (each of Malaysia’s nine states has a monarchical ruler and they rotate the role of Agong, or king, every five years) to take action, had meetings with politicians from both sides of parliament, regulators, ambassadors, and, ultimately, Mahathir, whose shadow continued to be exceptionally long over Malaysia.

In July that year, the WSJ reported that a payment of $681 million had gone into Najib’s personal account, which remains the heart of the whole scandal. Two weeks later, at a Ramadan gathering at the prime minister’s house, Nazir says his sister-in-law Rosmah openly threatened him, and from this stage any pretence of civility ended.

In the weeks that followed, The Edge would be suspended, the Attorney General turned up at his office to find the doors locked and Police Special Branch blocking his way and telling him he was retiring on health grounds, and Najib turned increasingly desperate in defending his position.

“I was warned that my name was on a list of people to be taken in for questioning under the sedition laws, on the grounds I was apparently party to an illegitimate attempt to unseat the prime minister,” Nazir writes.

Today, Nazir is clearly a little uneasy talking about 1MDB and his relationship with Najib, even though he has put the whole story in writing and published it now.

“You know, I did my bit in terms of flagging it out to various people. Did I do enough? Who knows?”

Certainly, he kept CIMB out of it from the outset, even when it was difficult to do so because 1MDB deals were so very lucrative. But his objections were chiefly in the background, partly, it appears, so his mother didn’t have to see a public battle between her sons.

Nevertheless, I spoke to Nazir frequently throughout this time and can confirm he was not one of the people who conveniently changed their stripes when Najib lost power in the 2018 election; he objected to 1MDB from as soon as anyone had heard of it.

I can remember meeting with Nazir right in the middle of all of this in 2016, in the Menara CIMB tower by Kuala Lumpur’s Sentral station. I had been sure he would cancel: the US Department of Justice had released a 130-page complaint into 1MDB two days earlier.

“Well, when you agree to an interview, you don’t imagine what’s going to happen two days beforehand,” he said then with a smile.

I did my bit in terms of flagging it out to various people. Did I do enough? Who knows?

We talked about some of the issues of the day – Asean, his decision to bail out of a planned three-way merger with RHB Capital and MBSB, digital banking – but 1MDB hovered in the background throughout. He spoke about it with tangible sadness at what it was doing to the global reputation of his country.

By then he had taken to putting increasingly daring posts on Instagram, including one invoking Game of Thrones.

“The parallels with GoT continue,” he wrote. “The future terrifies me: I just can’t see how our institutions can recover, how our political atmosphere can become less toxic, how our international reputation can be repaired.”

I wrote then: “He is perhaps one of the few people left in Malaysia, former prime minister Mahathir Mohamad being another, who can get away with criticism of the government.”

But by then, he was no longer just a behind-the-scenes figure, but had been dragged into the scandal himself.

Years earlier, he had been asked by Najib to cash cheques – $7 million of them – of donations ahead of the 2013 election, which Nazir did through his own personal account. It later emerged, he says to his great shock, that some of those funds had been linked to 1MDB.

Shortly after this became clear, Nazir suspended himself and asked the board to investigate him; the board in turn appointed Ernst & Young, which exonerated him. He returned to work. But this, and the change of government in 2018, meant the writing was on the wall for him at CIMB, the bank he had built, since it was still technically a government-linked company and there was a new government with a new broom.

When he finally left, a year earlier than planned, he was unable to attend one of his own leaving parties in the Jakarta office because he found he had been placed on a no-fly list by the government.

“There was an instance where Najib asked for some help,” he says now. “And I said fine, I can help you on a personal basis. I thought it was normal political funding.

“It’s quite ironic, because I thought he was doing it in a good way: in the old days, it was all just cash moving around, whereas Najib was wanting to put contributions to the political party in bank accounts, which I thought was good because it’s auditable.”

When it became clear that the funds were linked to 1MDB, “that got me into hot soup. I tried my best to explain everything, but when you get hit by something like this, all your opponents basically smell blood. It’s very, very difficult to shake off.”

Nazir, who had also been on the board of the Khazanah sovereign wealth vehicle and the investment panel of the Employees Provident Fund, Malaysia’s powerful pension fund, lost all these roles under the new guard, even though he says Mahathir was supportive.

Closure

Moving on, Nazir has taken a great interest in the idea of political systems, and his book includes many pages of suggestions about cleaning out the rot he still thinks exists within the Malaysian system. He is a member of the international advisory board at the Blavatnik School of Government at the University of Oxford, and clearly draws a great deal intellectually from it.

He also launched a private equity fund, Ikhlas Capital, alongside Cesar Purisima, the former secretary of finance of the Philippines, former Indonesian minister of trade Gita Wirjawan and long-time CIMB colleague Kenny Kim. They focus on Asean.

He’s also chairman of Bank Pembangunan, a national development bank focused on small and medium-sized enterprises. But he reserves his greatest enthusiasm for talking about his role as chair of PLS Berhad, which runs plantations of durians, the famously divisive fruit with an aroma so striking it is banned on Singaporean public transport.

PLS’s durians are from Raub in Pahang, and its top-of-the-range fruit is the Musang King.

“It is the Bordeaux of durians,” Nazir says.

And family?

Najib has already been sentenced to 12 years’ imprisonment, which he is appealing, and he faces several other trials (and won’t serve jail time until they are concluded). But Nazir hopes they can overcome what happened between them.

“I hope our relationship can go beyond what happened. You know, I’ve never stopped talking or being able to speak to him. We remain brothers, and there are family events where I attend and he attends, and I think we both do our best to try not to think about this stuff.

“Then hopefully one day we’ll be able to put it behind us because… our father died young. We were close.”

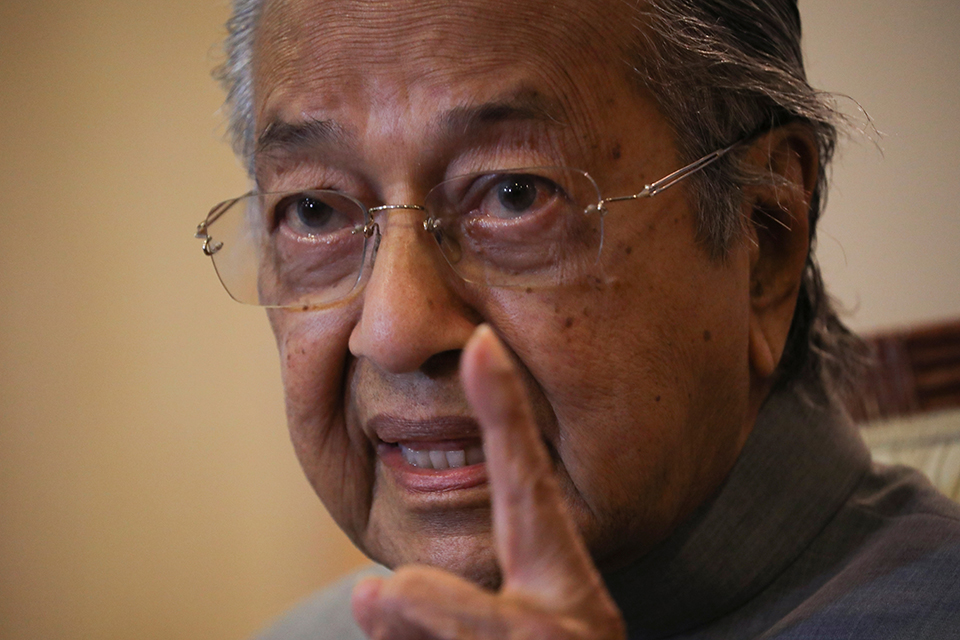

Nazir on Mahathir

One of the most interesting elements of Nazir’s book involves his occasional portraits of former prime minister Mahathir Mohamad. One telling anecdote involves Nazir being told off at great length by Dr M in 2011, long after he left office but with none of his gravitas diminished.

Nazir had crossed Mahathir by inviting former UK prime minister Tony Blair to speak at the launch of the Asean Business Club in Kuala Lumpur, unaware that Mahathir was about to stage a mock trial of Blair and former US president George W Bush for war crimes in Iraq.

“Even though he had retired years before, Mahathir’s views still mattered,” Nazir writes. “Such was his aura that people still wanted to please him; it was almost ingrained in us. I didn’t want him to be angry with me, so I went to his office to explain myself.”

It did not go well.

“He gave me an almighty dressing down for half an hour. I looked down at my feet in silence. It was like being told off by my housemaster at [UK boarding school] Oundle, who would always make you feel you had let yourself and the institution down badly.”

Surviving this, Nazir later went to see Mahathir in London to seek his intervention in 1MDB against Najib. Nazir recalls that after an hour, Mahathir said: “Why is it me that has to do something about it? I’m retired.”

“Well, sir,” replied Nazir, “You have to do something because you made him prime minister.”

One could argue that Mahathir’s remarkable return to power, on the opposite side of the political spectrum to the first time, began here.

Asked today about Mahathir’s legacy, Nazir says: “Obviously there will be a wide range of views. And I never doubted his motivations. I think he’s a true nationalist and he wanted what was best for Malaysia.

“But then, he felt that he knew what was best for Malaysia, and that’s where some of the problems lie. He’s a sort of end-justifies-the-means kind of guy. And he’s a doctor… so he ran the country that way.

“He wanted that concentration of power. He felt that to get things done, he needed that power.

“Nothing wrong with the motives. Something wrong with the methods.”