In its ninth year, Invesco’s Global Sovereign Asset Management Study has become one of the most important and useful chronicles of sovereign wealth fund and central bank investment behaviour.

The firm conducted 141 interviews this time around, involving 82 sovereign funds and 59 central banks. Between them, the interviewees manage $19 trillion in assets. It is worth knowing how they think.

Here are the stats that most interested Euromoney and what we think they mean:

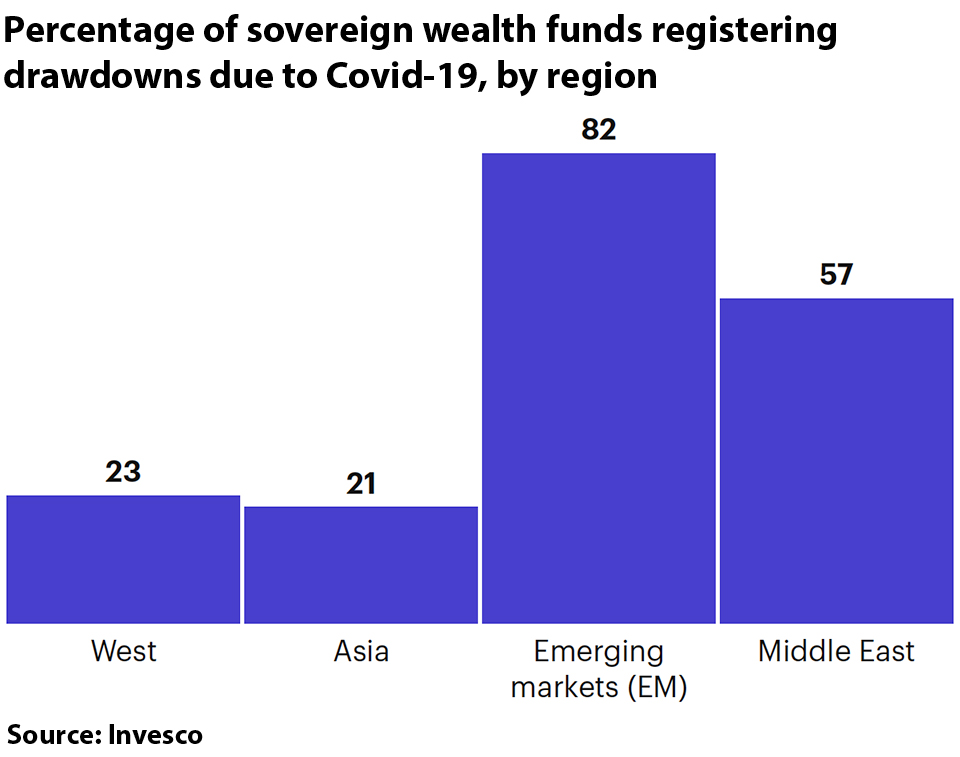

1. More than one-third of sovereign investors interviewed in January and February 2021 saw drawdowns, and 78% of liquidity sovereigns – those that exist to act as buffers to economic shocks and invest on short time horizons – did so.

Thanks for your interest in Euromoney!

To unlock this article, enter your e-mail to log in or enquire about access: