Rapid and widespread digital adoption by banking customers, and accelerated digitalisation across financial services in response to Covid-19, have expanded the opportunity for fraud, and money laundering in particular.

In fact, anti-money laundering (AML) compliance breaches in the first six months of 2020 outstripped the total for 2019. Strikingly, fines during that six-month period were 40% higher than for the whole of 2019.

While fines may be small relative to industry revenues, the damage caused to customer trust and business disruption are considerable, and opportunities to leverage operational efficiencies from automated compliance processes are overlooked.

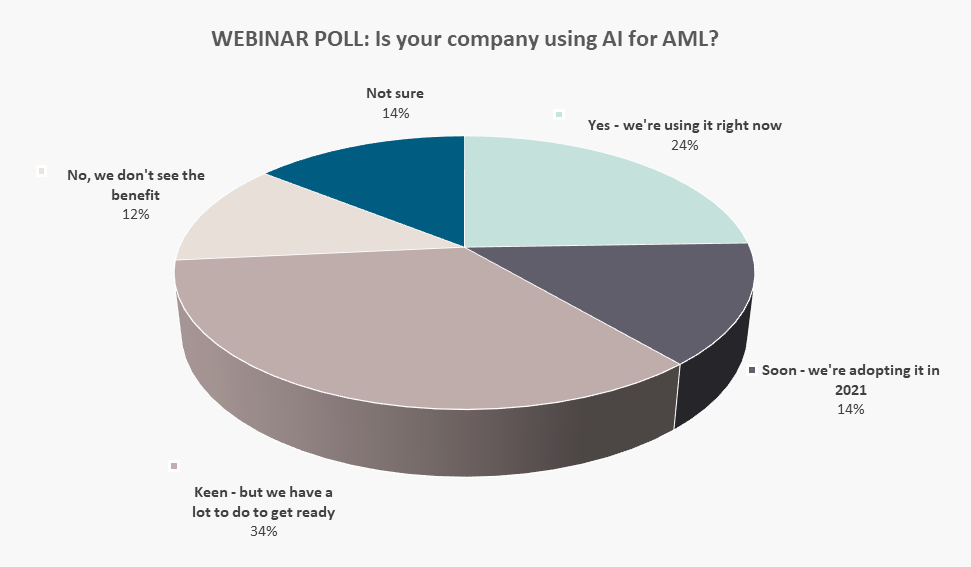

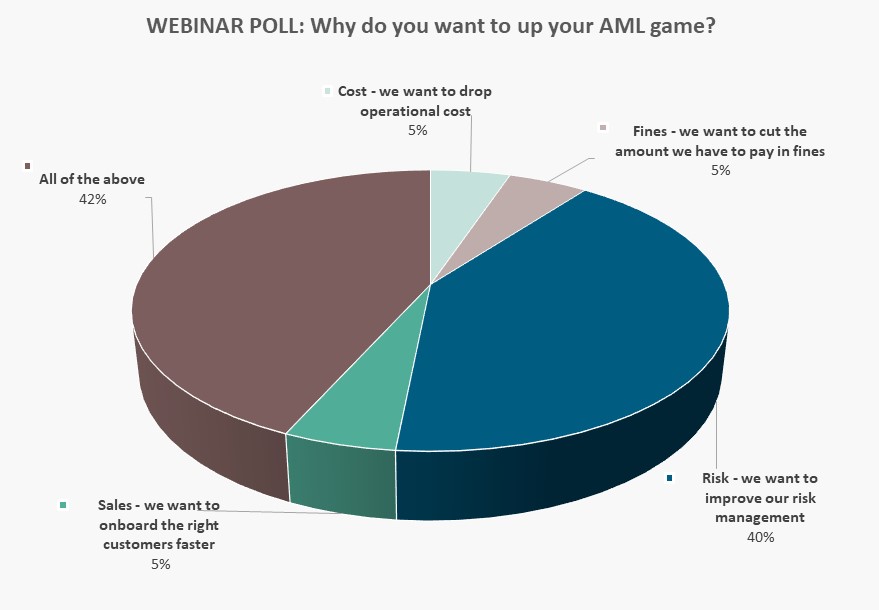

In a recent webinar hosted by Euromoney and Banking Circle, a panel of industry experts discussed the future of AML and compliance in the digital age. The panel delved into issues including the role of AML in the broader context of digital transformation, the essentials that should be part of an organisation’s AML arsenal, and how compliance today requires more agility than ever.

You can watch the webinar on-demand here, or read on for our summary of the key takeaways from the event.

Build your foundation first

As with many areas of the financial services sector, legacy systems and outdated IT are cited as roadblocks when it comes to creating a modern AML arsenal.

Indeed, Banking Circle’s soon to be launched research paper – which surveyed industry decision-makers from across Europe – found that 42% of senior bankers cited outdated legacy technologies as a major issue in embracing new advances such as AI in AML.

However, the webinar panel agreed that creating a solid foundation is a pre-requisite before looking at how to utilise the latest technologies and innovation.

“[AI] is essential to the AML kitbag, but it is not the right place to start,” said Dave Burns, chief revenue officer at Napier AI, and end-to-end intelligent compliance platform. He added that it’s common to see organisations jumping straight to AI before getting the basics right.

“The right place to start is with a fortified and robust set of base capabilities, maximising your use of available data, an optimised and sophisticated policy, and a focus on increasing efficiency within the organisation to then create the headspace and platform to be able to go to the next step,” explained Burns.

Chris Caruana, vice president of AML solutions at Feedzai, a data science company that prevents, detects, and remediates fraud risk for financial institutions, echoed that sentiment and stressed the importance of high-quality data as part of that foundation.

“A lot of that [data] probably exists already within your organisation – it’s about unlocking that first, as well as having the right people and processes in place,” said Caruana. “You can ‘turn on’ AI tomorrow, but without the right structure it will fall down quickly.”

AML should be part of digital transformation

With AML an increasingly prominent compliance and regulatory requirement, there is a growing opportunity for banks to approach it within the context of the broader digital transformation agenda, according to Livia Benisty, global head of business AML at Banking Circle.

While there is a huge focus across the industry on digital transformation, this tends to be heavily applied to commercial areas such as product, which means AML can slip down the priority list, explained Benisty.

“In financial services, if you’re not continually digitally transforming, you’re probably going to get left behind,” she said. The industry players whose infrastructures have been built to allow for constant change will be best placed to continually innovate and utilise the best technologies, Benisty added.

According to Jane Jee, CEO at Kompli-Global, organisations need to consciously approach AML, taking account of the new technologies available and must move beyond the traditional three lines of defence compliance model, which she described as outdated in today’s landscape.

“We need to sit down and discuss the new framework we need to put in place,” said Jee, adding that the industry can do much more to leverage the latest technologies and harness a range of available data in order to reduce financial crime.

While good quality, clean data is key, Banking Circle’s Benisty highlighted the need for a strategy in which AI is the final overlaying piece of a holistic approach.

“I don’t think you need a huge amount of data, but you do need it to be good quality,” explained Benisty. “It’s not about filling the gaps that you have with AI, it’s about looking at how you use everything that you have to enhance an AI tool, and to create good AI or machine learning.”

Banking Circle’s latest white paper, which asks Europe’s senior decision-makers in banking how the current approach to AML can be improved, will be released later this month. You can register to receive it here.

The panel:

Dr Louise Beaumont, chair, Open Banking and Payments Working Group, techUK (moderator)

Livia Benisty, global head of business AML, Banking Circle

Dave Burns, chief revenue officer, Napier AI

Chris Caruana, vice president of AML Solutions, Feedzai

Jane Jee, CEO, Kompli-Global