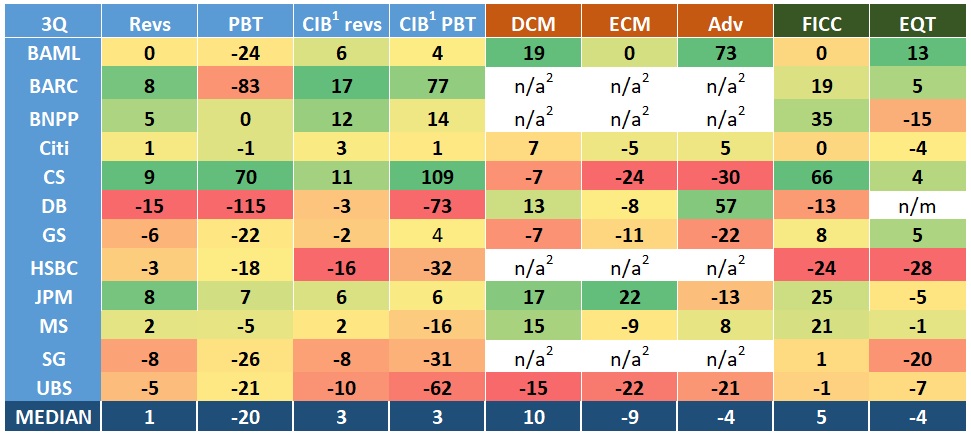

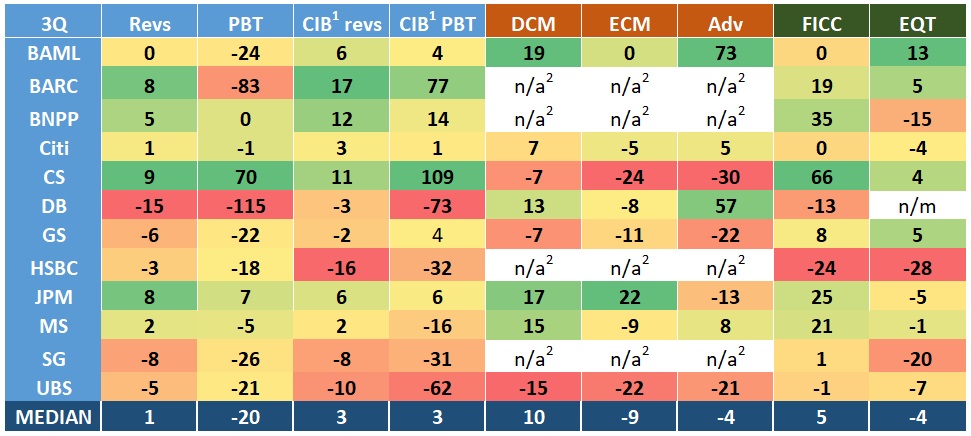

Investment bank quarterly heatmaps

numbers are percentage change figures for Q3 ’19 vs Q3 ’18, then YTD ’19 vs YTD ’18

1 CIB is ICS+IB at GS, IS at MS, GB+GM at BAML, CIB at JPM, ICG at Citi, IB at DB, CIB at BARC, IB at UBS, GBM at HSBC, GMIS+F&A at SG, CIB-related at CS, CIB at BNPP

2 BARC, BNPP, SG and HSBC do not break out DCM/ECM/Adv revenues

Source: Euromoney, bank results announcements

[ jump to: FICC | Equities | ECM | DCM | Advisory ]

What they said about…CIB (Percentage change figures are Q3 ’19 vs Q3 ’18, then YTD ’19 vs YTD ’18)

Bank of America (+6%, flat): Quarterly investment banking fees, excluding self-led transactions, were up 27% on a strong debt capital markets and advisory performance.

Thanks for your interest in Euromoney!

To unlock this article: