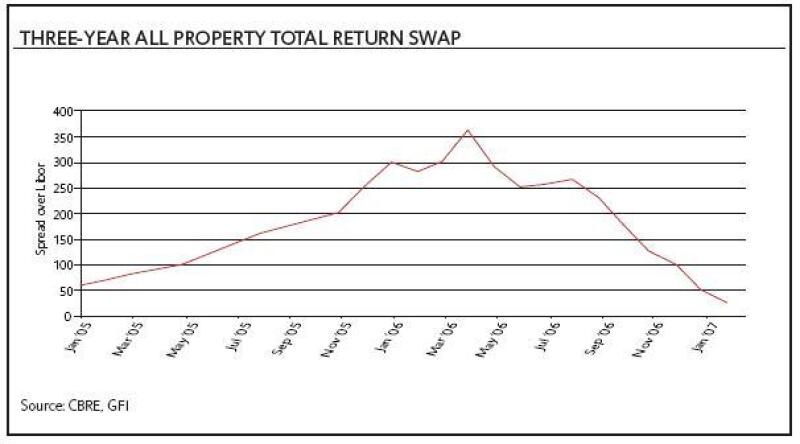

Property derivatives spreads have fallen from 200 basis points to 280bp in the summer of 2006 to 20bp to 50bp for a December 2011 contract for an all-property total return swap. Is this a sign that the market sentiment towards property has fundamentally shifted, or is something else driving this? The first thing to note is that in the summer there was huge confidence in the returns from property over the remainder of the year – and this was borne out by subsequent returns. The IPD monthly index delivered a total return of nearly 14% between March and the end of January (8.4% from the end of June) compared to about 4% and 3% for cash (the other leg of the swap transaction) respectively. For a December 2011 contract this alone would explain a nearly 200bp fall from the spreads available last April and a roughly 100bp fall from the spreads available in the summer. Secondly, interest rates have increased considerably over recent months – the five year swap rate is now over 5.6%, compared to less than 5% in the early summer last year and around 5% to 5.25%