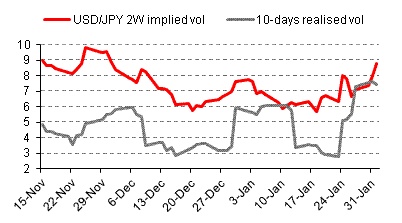

“The higher vols reflect both the higher realised volatility and the possible resumption of the central bank’s fight against the strength of the yen,” says Olivier Korber, derivatives strategist at Société Générale. Realised volatility has risen sharply as spot has fallen rapidly towards ¥76 after testing its upper range at ¥78.30 less than a week ago, though implied volatility in the front end is now well above the realised level.

One-month implied volatility is now trading at 8.4, up from 7.9 on Tuesday and well above Friday’s level at 6.9. Korber notes that the volatility curve has also now inverted in the front-end, the first time since December. One-week vol is trading above 9.0, while two-week vols are approaching a similar level and their highest point since November.

| USDJPY vols on the rise |

|

| Source:SG |

Risk reversals for USD calls are now reaching levels not seen for over 10 years. 3-month USDJPY risk reversals are still in positive territory for the first time since 2002, now trading at 0.13 as traders have piled into options, with topside strikes as spot moves closer to the intervention zone between ¥75 and ¥76. The1-year risk reversal, while still in negative territory is however at 10 year highs, trading at -0.30.

The Bank of Japan last intervened in record amounts on October 31, when USDJPY hit a post-war low of ¥75.35. The aggressive intervention subsequently sent USDJPY as high as ¥79.55, before large hedging demand from Japanese exporters helped absorb the surge in liquidity bringing the yen back below ¥78.00 against the dollar.