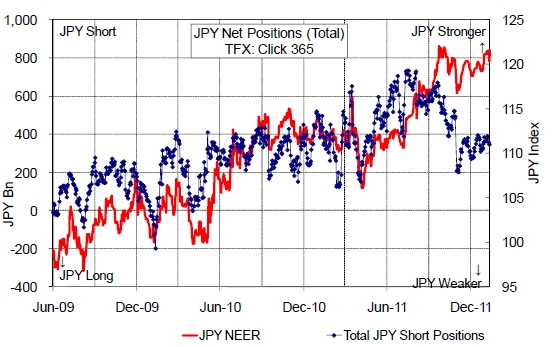

Japanese retail investors, colloquially known as “Mr and Mrs Watanabe”, have traditionally pursued contrarian FX strategies, buying foreign currency during periods of JPY strength and selling when the JPY weakens. The correlation between yen strength and margin traders selling the currency has been very robust throughout the financial crisis and, more recently, the European sovereign debt crisis, with intervention and increased regulation on retail trading having little to no effect on the Japanese retail trading community.

However, towards the end of last year, this investment pattern has seemingly broken down, with the current bout of yen strength associated with much less selling than the data over the last few years would have suggested.

| TFX Japanese retail trading and JPY NEER |

|

| Source: Citigroup |

“Whilst it is possible this divergence could be a temporary aberration, it could represent the beginnings of a shift in the composition of Japanese portfolios if investors move towards other securities instead of FX margin trading,” says Todd Elmer, G10 FX strategist at Citigroup.

If this apparent shift in trading patterns is sustained, the divergence could have important trading implications, says Elmer.

Some estimates show the Japanese retail sector accounts for as much as 30% of the total market for the dollar/yen, and a lack of yen supply from this sector could leave USDJPY more vulnerable to downward pressure from traders in other sectors. This is particularly true at a time when risk aversion is still elevated and US yields are forecast to remain low for some time.

Furthermore, as well limiting the scope for rises in USDJPY, reduced activity from the retail sector – which for so long has helped dampen large swings in the currency through a contrarian trading style – could also fuel higher volatility in the yen.