Headlines

• Moody’s: France’s AAA rating could come under pressure if debt/GDP ratio continues to rise

• German finance minister Wolfgang Schaeuble wants to reduce influence of ratings agencies, saying S&P hasn't understood the progress eurozone governments have made towards restoring their public finances

• Japanese core machinery orders rise 14.8% in November – well above the consensus forecast of 6.0% increase

• UK January Rightmove house prices down 0.8% m/m, with the annual rate dropping to +0.4%

• Eurozone banks park a fresh record €493 billion overnight with the ECB

Market reaction and flows

|

USD The dollar moved broadly higher, making gains against most Asian currencies, as Asian equities traded with a risk-off tone after Friday’s downgrade of nine eurozone countries by Standard & Poor’s.

A pullback in European stocks helped stem the dollar’s gains, while a US holiday might depress market reaction on Monday. Still, traders generally were looking to buy the dollar on dips given the heightened anxiety on financial markets.

|

EUR EURUSD remained vulnerable after the S&P downgrade, which saw it hit a 17-month low around $1.2625 on Friday as short-term investors and fund names abandoned the single currency.

Traders note strong bids around $1.2620 in EURUSD ahead of large option barriers at the $1.2600 level.

While many believed the downgrades had been priced into the market, with short-term speculators holding record short positions in the euro, some said reserve managers were not fully positioned for the move.

That, along with continued worries over the potential for a Greek default, should keep pressure on the euro, although talk that the ECB was aggressively buying Italian government debt and a rebound in European stocks on Monday helped keep EURUSD above its lows.

Meanwhile, EURJPY also dropped to an 11-year low just above large option barriers at Y97.00. Traders said a move through the option barriers could provoke further losses in the euro.

|

GBP Cable started the London session in a lively fashion, finding Middle Eastern bids at $1.5280 which saw cable move up to $1.5330 before encountering offers and settling around the $1.53 figure.

Though Sterling has benefited from demand Gilts in recent weeks, last week’s sell off in GBPUSD illustrated sterling weakness, which traders say has increased with risk of a break below $1.5250 support, should the slew of UK data this week undershoot expectations and cause the prospect of further QE to be more heavily priced in.

|

CHF EURCHF fell to a four-month low of SFr1.2068 on Friday as traders looked to test the resolve of the Swiss National Bank to enforce its SFr1.20 floor after the move lower in the euro and the resignation of SNB chairman Philipp Hildebrand last week.

Buyers were noted around SFr1.2070 in Europe, ahead of option barriers around the SFr1.2050 level. Gains were limited, however, with offers from short-term accounts noted above SFr1.2100.

|

AUD AUDUSD held up well in the face of the eurozone debt downgrades, with commodity-linked currencies generally showing only limited reaction to Europe’s woes. AUDUSD found support from Asian accounts around $1.0250 as EURAUD fell to record lows at A$1.2255. Profit-taking pulled EURAUD back from its lows, but traders pointed to selling interest above A$1.2300.

Positioning

The latest IMM Commitment of Traders report, issued by the CFTC, showed the strongest selling interest by non-commercial traders was in EUR, bringing the net short to a new record high for the third consecutive week.

The EUR net short now stands at 155,200 contracts, an increase of more than 16,000 contracts over last week’s previous record. As a percentage of open interest in the currency over the week covered, the EUR net short was 52.7%, close to the record 56%, suggesting strong conviction across the market.

Investors reversed some of last week’s USD selling, net buying $1.39 billion and bringing the total USD net long to $17.87 billion. The market is now long USD against every currency listed on the IMM barring AUD, NZD and JPY.

Aside from USD buying and EUR selling, last week saw decent buying interest in the commodity currencies. The AUD net long position rose by 7,000 contracts, breaking the 50,000 mark for the first time since September while market more than doubled its NZD long exposure, net buying 2,600 NZD long contracts, bringing the Kiwi long position to over 5,000.

However, bearishness in CAD has not receded as investors net sold more than 5,000 contracts, the second largest increase in short positions after the EUR. This brings the CAD net short to 28,649 – now the third largest short position after EUR and GBP.

Options

Vols were on the rise again after Friday’s sovereign downgrades, with one-month vols on average 0.4 vols higher than the close on Friday across G10 currencies. EURUSD one-month were the biggest mover, up one vol to 12.5. Interestingly, risk reversals are near their lows and have barely moved on Monday, though the consensus view among option traders is that riskies seem to have found a base around current levels at 0.95.

All eyes are now on the shape of the vol curve, after shorter-dated vols came off in the New Year. The big question now is, is there any substantial buyer of vol that would underpin the market? When one considers where six-month vols were trading in the last quarter of 2011, then current levels represent pretty good value, traders say.

|

| Source: SG |

What to look for: Sell EURUSD; S&P downgrades are not fully priced in

UBS recommends selling EURUSD with a target of $1.2250 and a stop at $1.3050, believing that the ratings downgrades that occurred on Friday night will have a greater impact on the euro than just one day’s price action would suggest.

The bank says while private investors have largely expected France to lose its AAA status, central bank and sovereign wealth reserve managers were not fully positioned for such a move.

“Last month, we visited clients in the Middle East,” says Mansoor Mohi-uddin, head of FX strategy at UBS. “We felt the region’s main players had largely rotated out of peripheral eurozone assets into the larger core markets of the eurozone. They had not, however, cut their outright euro holdings.”

But with Germany now the only eurozone country left with an AAA rating that isn’t at immediate risk of being downgraded, says Mohi-uddin, Middle East official investors and Asian central banks are likely to start cutting some of their exposures to the eurozone.

“This is because the German bund market at around $1.5 trillion in size cannot absorb all the estimated 20-30% of foreign central bank reserves [$10 trillion held globally] and sovereign wealth funds [estimated $3 trillion] held in eurozone assets,” he says. “This suggests there will be further selling by official investors of the euro during the first quarter of 2012.”

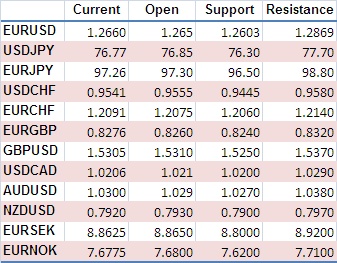

Spot, 06.30 EST

|