Citi has released a stark reminderto the markets that:

|

PSI failure risks the withdrawal of bailouts, disorderly default and even euro exit

Negotiators have a tough job getting a voluntary deal that will achieve sustainability

CACs will likely be required to ensure there are enough ‘volunteers’

Voluntary exchanges avoid default enabling the official sector to get a different deal

Non-voluntary persuasion (CACs) on a minority of holdouts means a CDS trigger event

A managed bond exchange with a CDS trigger is the right result for markets, in our

view

|

The bank was keen to point out that despite previous opinions on the fact the European Union (EU) could postpone "some of the harder decisions about debt restructuring", it has since "become harder to argue that Greece can be returned to a sustainable fiscal path through austerity":

|

Greece’s 2012 refinancing calendar raises the need for urgent debt restructuring. Even PSI on its own is not enough, in our view.

A bigger debt-reduction deal involving official sector creditors will likely have to be negotiated.

Without this OSI involvement, with a continuing contraction in GDP to 2016 (partly caused by further austerity measures), and a €100 billion debt reduction by the private sector, we estimate the country’s debt will still peak at around 157% in 2014 before declining very slowly.

We believe a failure to reach agreement on the PSI will make OSI impossible and risk accelerating an outright default, making it disorderly, and even raising the possibility of EMU exit.

|

The failure to reach an agreement on the PSI has caused concerns around the market – not just for a default but, as Euromoney has reported for some time, that Greece exiting the euro has become more likely.

Following this, Citi said that Greece has immediate refinancing needs – which, of course, we all know – but as widely reported at Euromoney and elsewhere, the backlog in paymentshas only catalysed the urgency of refinancing needs:

|

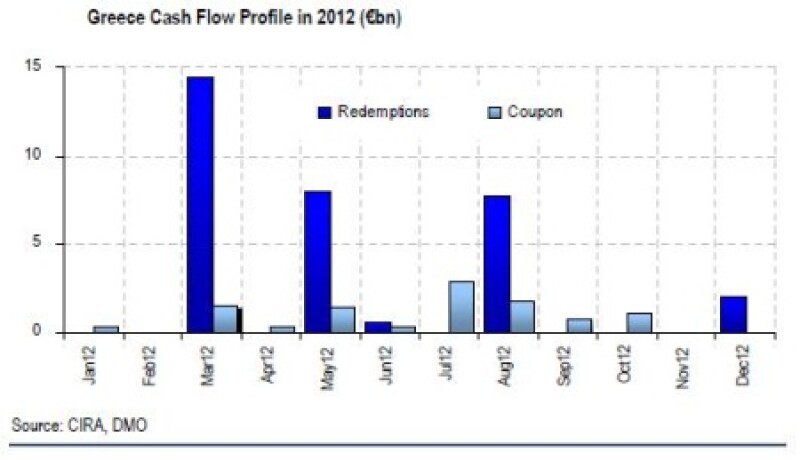

March is an important deadline because it forms a major slice of Greece’s 2012 refinancing requirements.

Paying a €14.5 billion bond redemption to give a deal more time seems unlikely. Greece has around €33 billion in bond redemptions this year.

The next bond to mature after the GGB 4.3% March 12 is the €8 billion GGB 5.25% May 12.

The full bond refinancing schedule including coupon payments is shown in [the chart on the right]

|

At the beginning of this year, Euromoney highlighted that not only does Greece need to receive its second round of emergency fundingto stop itself defaulting, but the urgency for it to even receive its previously agreed, yet delayed, payments means it is already severely behind on receiving its first load of cash.

On January 5, Euromoney reported that:

|

The next €5 billion tranche for Greece that was originally scheduled to be paid in December 2011 is now to be paid out in March 2012, Commission spokesman Olivier Bailly said.

A further €10 billion that Greece was originally to receive in March this year will now be paid only in June and all of those sums can also be delayed if inspectors judge Athens is failing to deliver promised fiscal reforms.

"That cannot be changed," Bailly said, referring to the three-month rhythm in paying out tranches of the first Greek rescue programme.

|

This is a huge concern, considering Greece has repeatedly cried out that the country faces the risk of defaulting, if the EU and the International Monetary Fund (IMF) did not pay out scheduled tranches.

These payouts are part of the aid that was promised under a €110 billion joint EU/IMF financing programme in 2010 in exchange for fiscal austerity and structural reforms. While €73 billion has been paid out, there is a €37 billion chunk that remains to be disbursed.

In the Citi report, it also states that CDS is likely to be triggered (emphasis ours):

|

It is possible that a PSI deal could be agreed without triggering CDS, but we think this outcome unlikely. An entirely voluntary PSI deal in which investors give up their old bonds for new bonds might be seen by many investors as a credit event, but legally a voluntary exchange is not a CDS trigger. If the merits of the PSI deal fail to entice enough volunteers and the remainder of the holdouts has to be forced with the insertion of retroactive CACs, then the deal is no longer voluntary and a CDS trigger is almost certain. The trigger point would be the stage at which the CAC is used to force holdouts into a deal.

|

For Citi's full report, click here

For more on this subject, don't forget to check out some of the highlights from Euromoney:

Disappointment spreads over lack of Greece deal

Country risk scores for European sovereigns decline in Q4 2011

“Greek sovereign CDS does not represent a big risk concentration”

Greek solution unlikely to trigger CDS

ISDA slams sovereign CDS critics