The bank forecasts that the renminbi will rise by 4.5% against the dollar, despite the recent run of weaker-than-expected economic data. While a slower domestic economy would typically imply a more hesitant approach by China regarding renminbi appreciation, Morgan Stanley believes it could have the opposite effect.

| USDCNY forecasts |

|

| Source: Morgan Stanley, Bloomberg |

Evan Brown, strategist at Morgan Stanley, claims weak economic data will provide room for fiscal and monetary policymakers to stimulate the economy using domestic tools.

He says the most important downside data miss was February’s CPI, which fell from 4.5% year-on-year to 3.2%.

“A more benign inflation outlook reduces concerns about over-stimulating the Chinese economy,” says Brown.

He believes Chinese policymakers will ease using domestic, rather than currency, measures for two main reasons.

First, because there are plenty of credit and liquidity tools available to the Chinese authorities, including reserve ratio requirement cuts, hikes to loan-to-deposit ratio targets and open market operations.

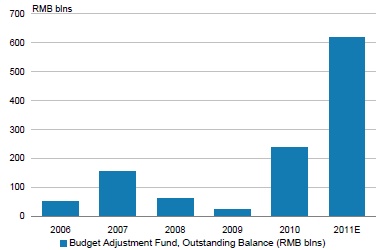

“Moreover, the government has plenty of infrastructure investment projects to resume or expedite, along with the budget to allocate to them,” says Brown.

| China could use "rainy day fund" to boost growth |

|

| Source: Morgan Satnley, MoF |

Second, 2012 is a year of high political sensitivity in both China and the US.

Brown says, with the US election approaching and China’s own political transition at hand, Chinese policymakers are unlikely to risk an escalation in Sino-US tensions.

“Failure to appreciate the currency could spark protectionist rhetoric or even legislation, which would be unhelpful during a time of economic and political transition,” he says.