EBS's average daily spot FX volumes (ADV) slipped 22% month on month in July to $106.7 billion, and 41% year on year after "exceptionally high volumes in July 2011 that followed a number of sovereign credit rating downgrades," Icap said.

|

| Source: EBS |

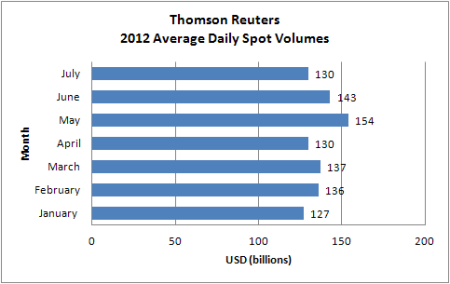

Thomson Reuters' ADVs in July were $130 billion, down 9% month on month and 14% year on year from $152 billion in FX spot trading volume in July 2011.

|

| Source: Thomson Reuters |

At the same time, CLS released its monthly settlement and aggregation data for July, which showed that average daily volumes submitted were down 10.5%.

Comparatively, FXall, servicing a mix of real-money and corporate clients, and hedge funds, increased its ADVs in the second quarter to $92.4 billion, up 8% on the same period last year. Growth was driven by an 18% increase in volumes traded with active trading clients, primarily banks, broker-dealers and hedge funds, which accounted for 23% of the total ADV. Trading with its relationship trading clients - corporates and asset managers, also rose, but by only 5%.

The decline in interbank trading volumes on EBS and Reuters provides further evidence, after last week's data from the Bank of England and the Federal Reserve Bank of New York, which showed spot volumes have been declining.

Although it is difficult to identify the exact reason for the reduced activity, a report published by Citi yesterday suggests that a decline in volatility could be the cause, as measured by intra-day trading and close-to-close ranges.

As the charts below illustrate, the ranges were much smaller last month than at the same time last year. Citi says that that this lower volatility leads to less of a need for frequent transactors, such as option writers or hedgers of underlying securities portfolios, to make adjustments to their positions.

| Intra-day trading range on EURUSD |

|

Source: CitiFX, Bloomberg

| Close to close trading range in EURUSD |

|

Source:CitiFX, Bloomberg

As we reported yesterday, US-based FX futures exchange operator CME released its July trading volume data on August 3; these showed a 29% decline in July trading volumes year on year, with FX options volumes down 7% year on year. But as Citi pointed out, open interest has actually risen, indicating that the market continues to grow.

Daily foreign exchange turnover averaged $2 trillion in the UK in April 2012, 2% lower than in October 2011 and down 5% year on year, according to the Bank of England's semi-annual turnover survey for the Foreign Exchange Joint Standing Committee.

Figures from the New York Fed's equivalent survey showed average daily FX turnover in April 2012 was $859.8 billion, down sharply from $977 billion estimated in October 2011.