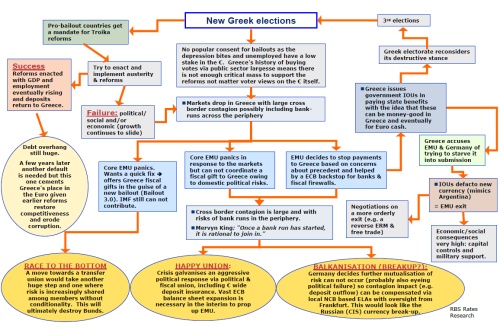

Indeed, as leaders around Europe try to turn the poll into a referendum on Greece’s membership of the single currency, a guide to the potential fallout from events in Athens would come in handy. Happily, research teams at banks have, presumably, been working overtime to get investors up to speed, with the chart from RBS, below, a particularly fine example (click on the image below to enlarge).

Harvinder Sian, European interest-rate strategist at RBS, says what is striking is the sheer complexity of the possible outcomes that are dependent on the many choices the Greek electorate and core Economic and Monetary Union policymakers will make in response to market pressure and prior choices.

For the record, RBS puts the probability that Greece will exit the euro in the medium term at 90%, based on the social risks from persistent and higher unemployment if it were to remain in the currency union.

For 2012, however, RBS says that probability is harder to pin down, given the sheer number of alternative pathlines outlined below.

“Forced to put a number on it, we assess 50%,” says Sian.