Headlines • ECB is preparing a €1 trillion cash-injection scheme for the eurozone ahead of a series of crisis summits this week – Sunday Times

• Germany’s Die Welt reports the US may lend to the IMF to support the eurozone

• Italian prime minister Mario Monti unveils €30 billion package of austerity measures

• Chinese November HSBC services PMI eases to 52.5 from 54.1

• Eurozone November services PMI revised lower to 47.5 from 47.8

• UK services November PMI rose to 52.1 from 51.3 in October

Market reaction

The euro found support, and the dollar and yen lost ground as stocks rose on Monday amid hopes that this Friday’s summit meeting of eurozone leaders would provide a solution to the debt crisis engulfing the region.

That said, data showed investors remained significantly short of the euro (see Positioning below).

Weekend reports were generally positive, with an article suggesting the European Central Bank was set to step up its bond-buying programme and suggestions that the US would fund the International Monetary Fund to bail out Europe helping the single currency.

Hopes that a meeting in Paris between German chancellor Angela Merkel and French president Nicolas Sarkozy on Monday would produce a credible plan on fiscal discipline also supported the euro.

News that Italy had announced an austerity budget ahead of schedule also put pressure on Italian government bond yields and helped to support risk appetite.

The dollar eased across the board as investors took on risk, with rumours that the Federal Reserve was set to cut the discount rate – the rate at which it lends to financial institutions – weighing on the US currency.

However, EURUSD was unable to break higher through $1.3450, amid unease that Friday’s summit could still fall flat. Gains in AUDUSD were also capped as Chinese data came in weak and investors awaited the Reserve Bank of Australia’s policy meeting on Tuesday, at which it was expected to deliver a cut in interest rates.

Elsewhere, GBPUSD was boosted by better-than-expected services data, while the USDJPY remained in a narrow range about the Y78 level.

Meanwhile, the Swiss franc continued to come under pressure amid heightened speculation that the Swiss National Bank was set to raise the floor in EURCHF to 1.25 after its policy meeting on December 15.

Positioning

Last week’s CFTC report showed bearish sentiment on the EUR hit new lows as net shorts from non-commercial traders reached 104,302 contracts, an increase by almost 20,000 from the previous week. The dollar value of EUR shorts as of November 29 stood at $17.4 billion, within spitting distance of the record $18bn net short seen in May 2010.

Aside from the EUR, investors increased their GBP short exposure by more than 10,000 contracts as market fears in Europe increased. The net short in GBP was calculated at 46,660.

The latest report shows speculative investors marginally cut back JPY long exposure by 2,633 contracts, though the market remains net long by 40,547 contracts.

CHF, where investors have been largely neutral since the imposition of the exchange rate floor by the SNB, saw a 50% rise in short positions, bringing the net short to 9,327 contracts.

Global growth fears and impending rate cuts from the RBA and RBNZ also saw investors cut back long positions in the commodity currencies.

The net long in AUD fell by 5,418 contracts, bringing the totally net long to 12,452 contracts. Similarly, positioning in NZD approached neutral levels of 3,718, down from almost 8,000 contracts the previous week.

The massive short position explains the swift rally in risk currencies on Wednesday after the surprise decision by global central banks to ease the cost of dollar funding.

Flows

EURUSD opened on a more optimistic note, buoyed by positive press reports that the ECB was considering a €1 trillion cash injection into distressed eurozone sovereign bonds.

Demand from an Asian sovereign and macro hedge fund around $1.34 saw EURUSD edge higher until meeting resistance and sell offers at $1.3450.

Traders say a string of buy stops lie above this level, and a pick-up in risk could drive the pair up to $1.3550 in the short-term.

One trader comments: “Given the event risk coming up this week, we are not wedded to a strong intra-day view. [We are] looking to buy dips towards $1.3330 and sell rallies above $1.3520.”

Japanese exporters limited topside in USDJPY with selling above Y78.00. This was balanced by demand from leveraged accounts around Y 77.90.

GBPUSD was well bid, up from 1.5590 in the early London session, with reports that a better-than-expected services PMI number had been leaked. After the official release confirming a higher PMI number, short-term accounts took profit around 1.5660 and cable drifted down to the 1.5630 area. EURGBP still continues to be buoyed by corporate hedging on dips below 0.8585.

AUDUSD continued to receive decent bids after strong equity performance, although upside moves were capped by weak Chinese PMI numbers.

Swaps

Despite the action from global central banks to inject dollar liquidity through the enhancement of swap facilities, tensions remain elevated on funding markets.

The premium paid for dollars remains high as lending between European banks is still strained, with concerns existing over whether there is a stigma attached to tapping dollar swap lines.

Benchmark three-month EURUSD cross currency basis swaps were little moved at -123 basis points on Monday. That is someway short of the -162 bp level hit last week, but still much wider than pre-crisis levels.

Options

Traders report subdued activity ahead of event risk later in the week, with markets eyeing progress over the eurozone debt crisis.

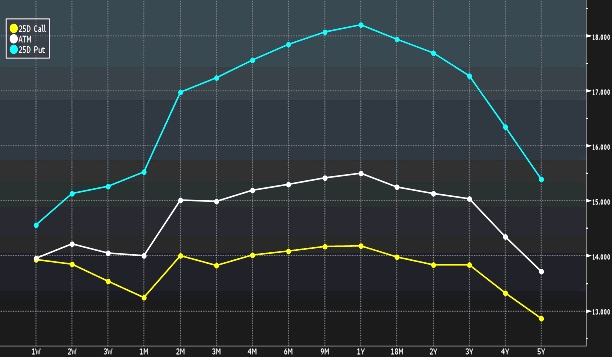

EURUSD 1-month at the money is now trading just over 14.00 and 1-month risk reversals are still drifting lower now at -2.2800. 3-month risk reversals opened the London session at -1.995 and have since moved to -1.89.

Options strategists say USDJPY 1m vol is now likely at its floor with the curve now reaching extreme steepness.

Generally, volatility has headed lower after the move from global central banks to inject liquidity into the market last week. Dealers say realised volatility should drop further over the holidays given limited trading opportunities.

| EURUSD volatility term structure |

|

| Source: Bloomberg |

What to look for

Commodity currencies, while not fundamentally affected by the European debt crisis and impending recession, are still subject to volatility from swings in risk aversion given the high-beta nature of AUD and NZD and so relative value trades can offer a more attractive risk/reward ratio.

Barclays Capital expects NZD to outperform the AUD over the next three months as interest rate differentials narrow, with the RBA expected to cut rates again at its policy meeting on 6 December.

Buying a 1-month AUDNZD put with a 1.28 strike at a 1-m forward reference at 1.3107 costs 26bp. Barclays forecast AUDNZD at 1.26 in a month which would yield a maximum payout at expiry of 5:1 if the forecast proves correct.

Spot, 7am, EST

|