When Mohamed Mansour stepped down as Egypt’s minister of transport in 2009, he was at a loose end. The cotton-trading business his father founded in 1952 had long been transformed into one of the world’s great private firms, Mansour Group, with industrial, banking and retail operations stretching from Sweden to Siberia to Singapore.

It was highly profitable, turning over $6 billion in annual revenues. Money was not an issue for the 67-year-old billionaire or his extended family in London and Cairo – nor was it ever likely to be. What he did need, though, was a fresh challenge.

So it was that Mansour found himself boarding a flight to New York in early 2010. At first, the trip was merely an extended vacation with a pinch of business thrown in. It was a chance to enjoy the delights of a great city, cast a gimlet eye over his family’s vast wealth (then preserved and managed by Citi), and meet a few choice contacts in property and finance (the group is a large owner of real estate in the US Midwest).

|

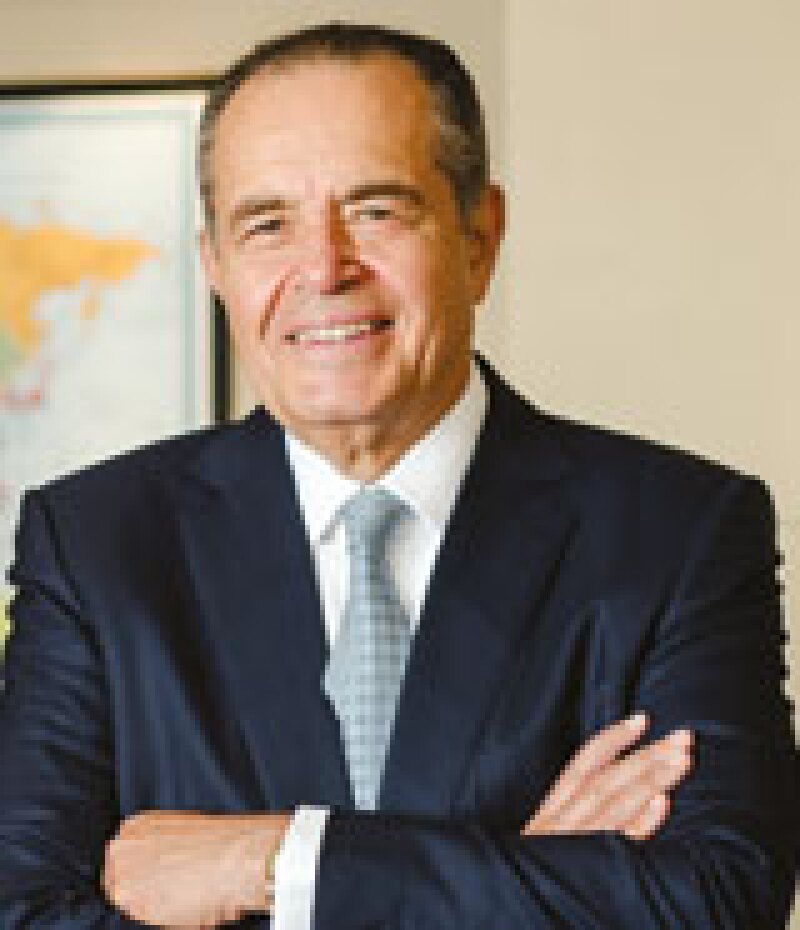

Mohamed Mansour |

New York’s finest soon got wind of his presence.