When Barclays set up its non-core division in May 2014 with about £115 billion of risk-weighted assets (RWAs), the task of selling them down in an orderly way by the end of 2017 looked a tall order.

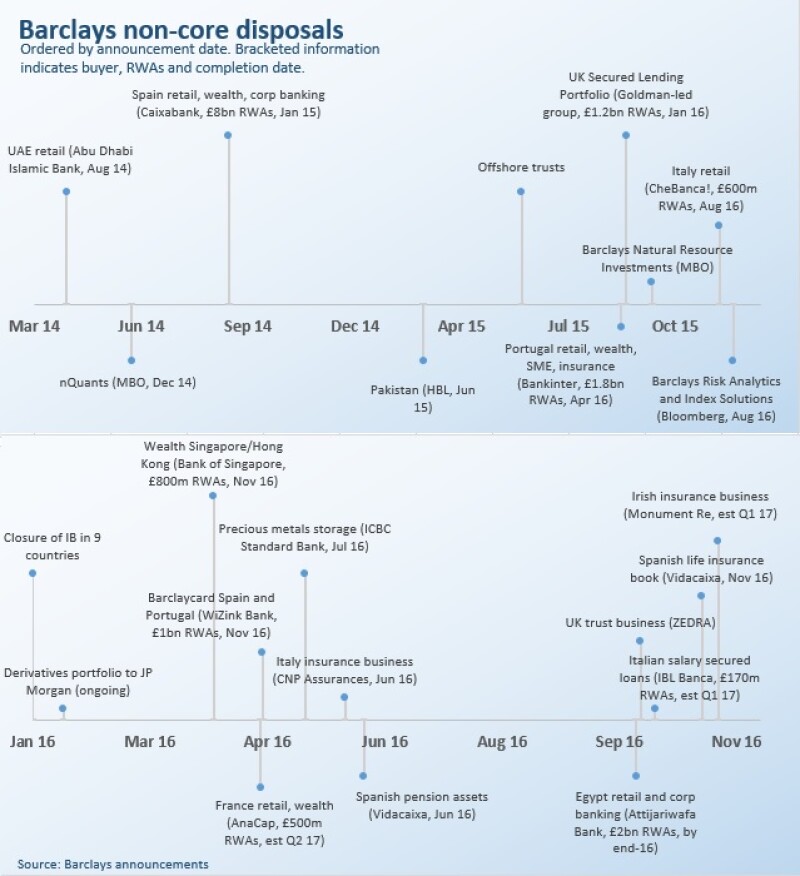

However, the bank has had a blistering 2016, completing or agreeing at least 18 publicly announced deals (see chart below).

Its latest – an agreement for the sale of its French retail banking business, announced on Monday – closes an important chapter in the journey, marking the bank’s final exit from retail banking in continental Europe. That process has seen it also offload retail banking in Spain, Portugal and Italy.

At its latest earnings announcement on October 27, Barclays announced that non-core RWAs had been cut to £44 billion – even after a one-off £8 billion increase this year when Staley added another slug of businesses to the exit plan.

The year’s tally has been extraordinary. In retail banking, the firm wrapped up the sales of its Portuguese and Italian businesses, to Bankinter and CheBanca!, respectively, as well as the French deal that it first announced in May and where an agreement has now been signed with AnaCap. Completion of that deal is expected in the second quarter of 2017.

Insurance disposals have proceeded at a frantic pace: the Portuguese deal included the insurance business, but separate transactions have been concluded covering insurance in Italy, Spain and, most recently, Ireland.

Wealth management also fell within the Portuguese and French deals, but the bank has also just closed the sale of its Hong Kong and Singapore wealth and investment management businesses to Bank of Singapore, originally announced in April.

Portfolio sales have come thick and fast, whether pension assets in Spain, salary secured loans in Italy or the continuing sale of a derivatives portfolio to JPMorgan. The offshore and UK trust businesses have been sold, as has the bank’s precious metals storage facility.

The summer saw the wrapping up of a deal to sell Barclays Risk Analytics and Index Solutions to Bloomberg. (Article continues below graphic.)

|

Those at the firm stress the scale of the pure M&A achievement represented by the deal tally. “To do all that we have done in 11 months is unbelievable,” says a senior banker at the firm.

The principal players in that task have been the non-core team run by Harry Harrison and, until recently, John Mahon, who changed roles to become head of the corporate and investment banking division for EMEA and Asia-Pacific in July.

The division is now well on track to end 2017 with its target of roughly £23 billion of RWAs, which will then be brought back into the core bank.

Perhaps most encouraging for the bank is the fact it has also made progress on two of its most complex and potentially problematic divestments. It agreed the sale of its Egyptian retail and corporate banking business to Attijariwafa Bank in October, in a deal that is expected to complete in December or January and will account for a further £2 billion reduction in non-core RWAs.

The disposal of Barclays Africa is the other element looming over the wind-down. It is a process that insiders describe as “massively complex” as a result of the huge number of dependencies that are involved – not least the stability of the South African economy, and many other African countries where Barclays has a presence.

However, the bank has made a start, selling a 12% stake in May through an equity capital markets placement. Barclays still owns just over 50% of the bank and plans to reduce its holding to the point where it can deconsolidate it from an accounting perspective – about 20%.

The significance of the Barclays Africa disposal is hard to overstate, as it is a crucial part of CEO Jes Staley’s plan to refocus the firm, but it matters for another reason too: Staley had to convince chairman John McFarlane – and grumbling shareholders – of the merits of the move, and more broadly of restoring the investment bank to the heart of the firm.

The fact he succeeded in doing so speaks volumes about Staley’s clout with the Barclays board – and his likely chances of success in being allowed to reshape the firm as he sees fit.