The immediate aftermath of the UK’s decision to exit the European Union roiled markets, but the effect on businesses was muted.

|

Natasha Lala, Oanda |

The FTSE 100 rebounded within days and has since soared, as have the FTSE 250 and 350. Economic data were better than expected, with the UK economy growing half a percent in the three months after the Brexit vote, dashing the dire predictions of Project Fear.

However, experts warn the harsh impact of Brexit will soon materialize, with the weak pound set to take its toll on UK companies’ bottom lines, notably those that import goods from abroad, such as retailers.

The pound has halved in value against the US dollar since June 24 to around 1.24, and has also hugely weakened against the euro to approximately 1.14.

Smart businesses that bought protection against future currency movements earlier this year – in the form of forwards and options – have largely been protected from the deleterious effects of the weak pound.

Some sophisticated corporates, such as Jaguar and SABMiller, hedge out far ahead. The car manufacturer’s philosophy is to have a consistent five-year hedging policy, while the brewer’s policy is to layer in FX forwards over the course of up to 18 months.

December deadline

However, most companies tend to hedge only to the end of their financial year, which is typically December. Most don’t hedge beyond this point due to the expense, says Sam Bett, director and specialist in FX at consultancy firm JC Rathbone Associates (JCRA).

|

Sam Bett, JCRA |

“The credit availability from bank and brokers becomes more expensive the further out you hedge,” she says. “[This] deters folks from hedging. Businesses have thus far been insulated, because they had hedging in place.”

Once a company’s hedge reaches the end of its life cycle, it can renew it with its counterparty – typically a bank or broker – but the cost of hedging has now soared, as banks factor in the drop in the pound and volatile markets.

Bett says: “My concern is that a lot of corporates are facing exactly the same issues, and wishing they had a better exchange rate in place. Unfortunately the only way to get a better exchange rate is by either selling some optionality to the bank or broker – that means adding more complexity into hedging and more risk.”

Four in 10 businesses (38%) are worried about currency volatility over the next three months, according to the findings of a quarterly survey conduct by currency broker World First.

Economic volatility around the US election and a weakening pound have opened up UK small and medium-sized enterprises (SMEs) to currency risks equating to £34.6 billion, according to World First. A quarter (23%) even said that currency volatility has impacted their business investment decisions in the third quarter.

Solutions

One solution for worried companies is to seek out natural hedges, says Natasha Lala, managing director at currency broker Oanda Solutions for Business.

Company treasurers can offset their expenses in one currency with any revenue denominated in the same currency, eliminating the need to exchange currencies and suffer a bad exchange rate. Multi-currency accounts can give treasurers a bird’s eye view of the business.

Lala says: “In a situation where a currency has continued to fall over a prolonged period, corporates can’t afford to lose time. Therefore, having the ability to manage multi-currency accounts in one place becomes a competitive advantage as it simplifies FX payments processes and practices, reducing time and potentially cost.”

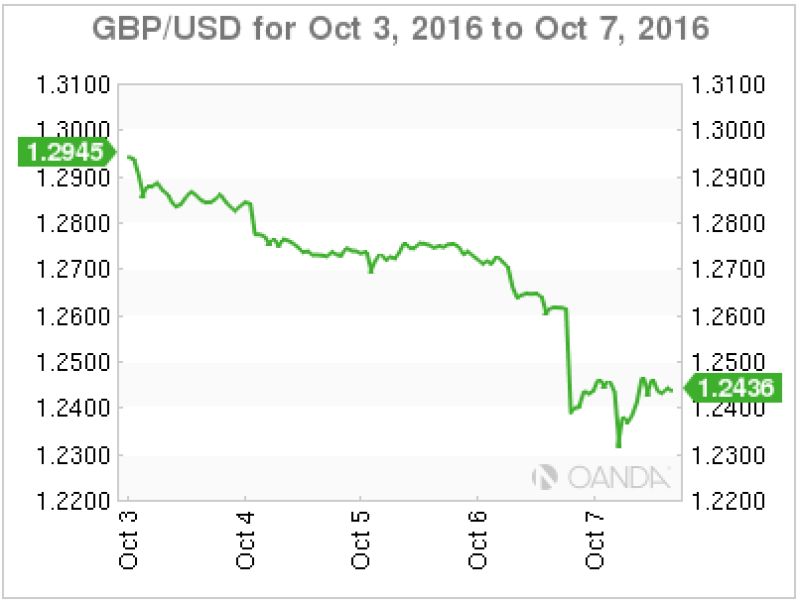

October 7 sterling flash crash |

|

Source: Oanda |

Volatile markets make hedging trickier too. In October, sterling plunged 6% against the dollar in the space of just a few minutes, for reasons that are yet to be determined. The Bank for International Settlements is investigating the flash crash.

James Lockyer, development director at the Association of Corporate Treasurers, says: “Certainly, corporates have to be cannier about hedging when markets are volatile. Even with a forward deal there is now a cost to hedging, which means that people have to think quite carefully what they hedge and for how long for.”

Be vigilant

Companies should make sure their efforts to manage their currency risk are watertight, advises Jackie Bowie, chief executive officer at JCRA.

Some companies try to eliminate the pain of FX through their supplier agreements, whereby they insist their supplier quotes everything in the company’s home currency, say the pound, even though the underlying cost of goods is in another currency, such as the euro.

The company, therefore, feels it doesn’t have to deal with the headache of currency conversion, as everything is quoted in its home currency. However, if the exchange rate rapidly moves against the company, it soon becomes a headache.

|

Jackie Bowie, JCRA |

Bowie says: “It surprises me the number of medium-sized companies that manage FX through supplier agreements. When you have big moves [like with] the cable flash crash, those supplier contracts get blown out of the water. The supplier will not take that FX risk on.”

It is then up to the company to negotiate a new price with its suppliers, which lacks the same certainty afforded by a forward contract.

Hedging experts advise companies to avoid being tempted by juicy strategies that offer a great headline rate, but come with a sting in the tail. Hedges that come with a binary option can go badly wrong and often resemble more of a bet than a safe hedge, as can leveraged trades.

Extendable options that give the bank or broker the power to extend the hedge can go horribly wrong, too, potentially locking customers into a bad rate for longer.

Companies should take heed from Sports Direct. The sports retailer had to issue a profit warning after declaring it could lose £35 million from the slump in the pound, and has come under fire for its weak hedging policy.