|

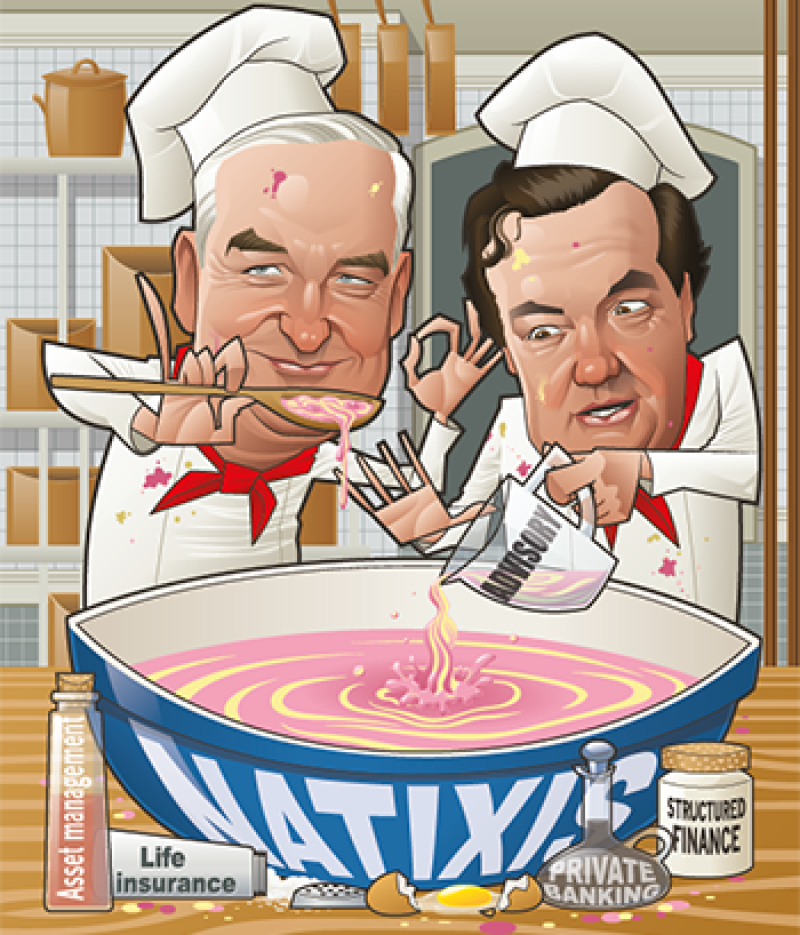

Illustration: Kevin February |

Many will remember an image of Natixis as the ugly duckling of French investment banks, with a shaky standing, even before it was bailed out in the sub-prime crisis. That’s no longer the case: Natixis’ market capitalization has increased by more than seven times since 2009. By price-to-book ratio, it is the highest valued French bank, and one of the most valuable banking stocks in Europe – a differential the recent sell-off has only accentuated. Natixis has gone from a millstone to the crown jewel of its parent, BPCE: the entity created from merged mutual lenders Banque Populaire and Caisse d’Epargne after Natixis’ near-death in 2009. Units within Natixis were BPCE’s fastest-growing income generators last year, above all asset management, but also insurance and private banking. Revenue growth in equity derivatives and bits of structured finance similarly stood out in 2015 results – part of an international wholesale banking push.

A key figure in Natixis’ market rehabilitation has been François Pérol: Natixis’ chairman, and chief executive of BPCE, now one of France’s biggest banking groups. Pérol’s leadership has had much publicity in France, due to his position as a close lieutenant to Nicolas Sarkozy immediately prior to his appointment to head of BPCE in 2009, when Sarkozy was still president of France.