By Clive Horwood, Peter Lee, Jeremy Weltman, Tessa Wilkie

For banks, 2015 was all about capital, and how they make a return on it. For sovereign credits, it was 12 months in which emerging market countries lost their momentum, but some fallen angels rose again in the developed world. Cash became core, liquidity rose to the top of the list of market concerns, and to some blockchain became the cure for many of finance’s ills. One thing is for sure: every piece of data tells a story.

Basel III Common Equity tier 1: Banks still need more capital |

chart-basel-iii |

Return on equity: Returns are volatile and low |

|

Investment banking: European firms face defeat |

|

Blockchain: Shared ledger threatens change |

|

Transaction services: Relationships count in cash management |

|

Cash management: Crunching the numbers on cross selling |

|

Green bonds: Corporates move in on green bonds |

|

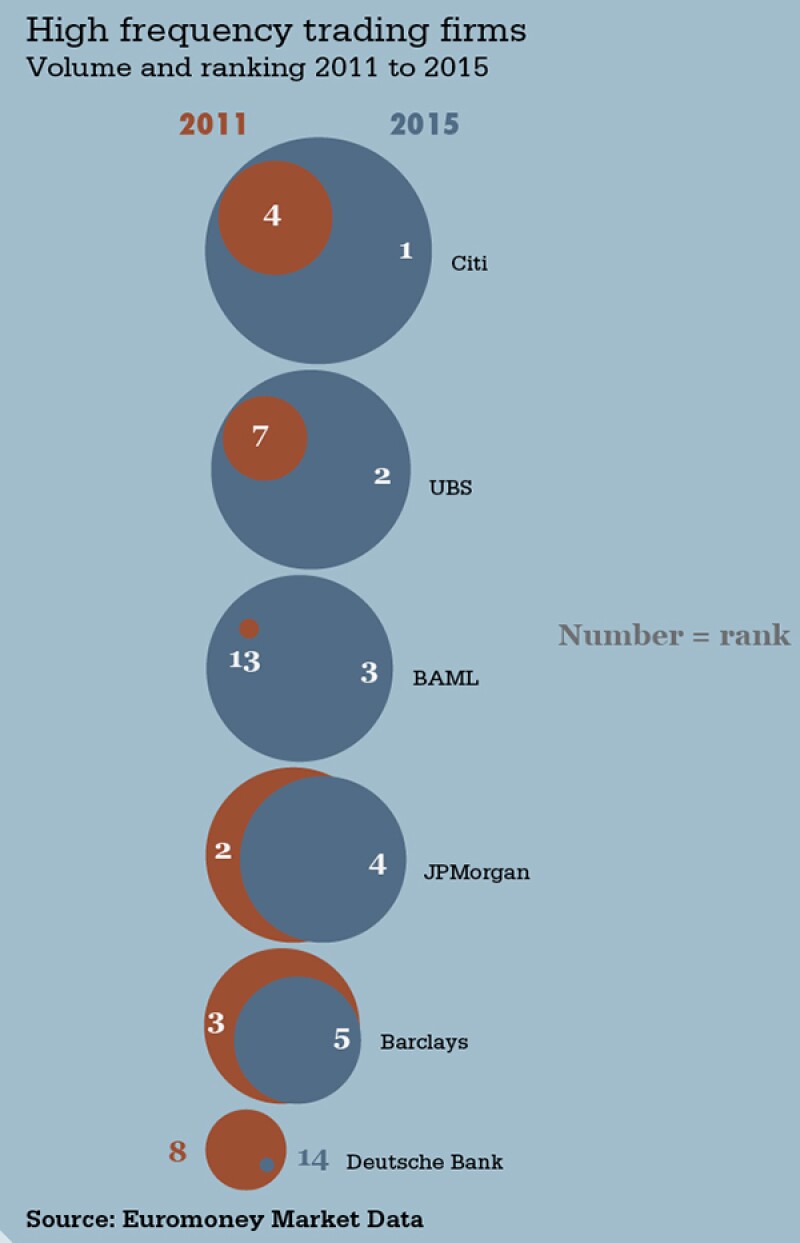

Foreign exchange: What about the high-frequency traders? |

|

Country risk: ECR calls the shots on credit rating actions |

|

Bond markets: Investors are clear – liquidity concerns are not overblown |

|

Euromoney data: Every data point tells a story... |

|