Fund managers at FQS Capital Partners, a London-based fund of hedge funds, are among many that have bemoaned the current lack of quality pure currency hedge funds.

|

In the past, trading currencies was relatively simple … Today, it is much harder to know how important any one factor is at any time Aref Karim, |

Pacome Breton, head of portfolio management at the firm, says: “We have been looking for a long time and since inception we have not once found a pure currency fund that compelled us to invest in it. It is a mystery why, with so many smart people trading FX, we didn’t identify one that generated high and consistent level of alpha.

“But we like niche players or funds that specialize in only one asset class, as we diversify anyway by investing in different hedge fund strategies. So we are open to investing in such a fund and will keep looking.”

Investors looking for currency exposure via hedge funds have other options. Global macro funds invest across a range of asset classes, including currencies, as do CTAs – systematic trend-following funds.

Allocations to FX vary in such strategies depending on the markets. They were relatively high in 2014, but look to have tapered off a little this year.

Breton says: “Macro funds started increasing their allocations to FX from around 2013, when many started shorting the yen, and last year FX was a massive profit generator for many of them, especially in the second half of the year.

“This year, a typical macro fund is up around 3% to 5% and likely to have generated half of that return from FX positions typically generated in January.”

He adds: “The macro funds we follow have had large allocations to FX for the past 12 to 15 months. In the past, fixed income has often been their real bread and butter, but right now FX has become a major allocation.”

Quality Capital Management (QCM), a UK-based global macro hedge fund, is a case in point.

Aref Karim, CEO at QCM, says: “In 2014 until around September, we had 30% to 40% of our portfolio’s risk weighting allocated to FX. Now it’s around 12%, but as the trends start to pick up we will buy in again.”

It is a similar picture for the CTAs.

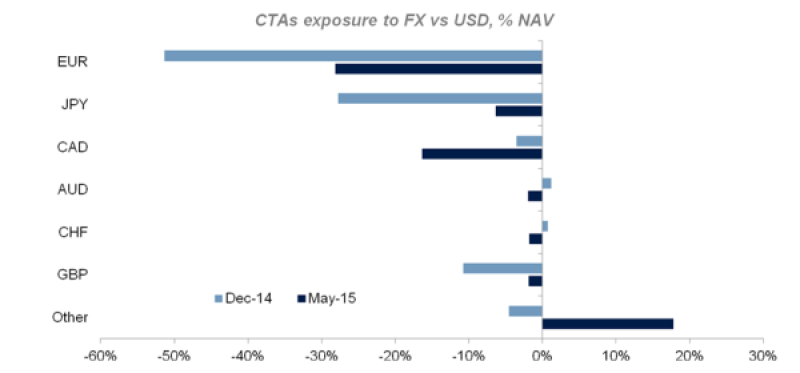

Philippe Ferreira, head of research for Lyxor Asset Management’s managed account platform, says: “FX was an important part of the returns for momentum managers last year, when we saw sustained trends from the dollar, euros and sterling.

“But over the course of Q1, these trends have been less strong and many managers have started to unwind their positions and FX is contributing less to their performance.”

Ferreira says at the end of 2014 systematic managers had an average net short position of around 60% to 70% of net assets in euros against the dollar, but that has been reduced to around 25% to 30% and might fall further still.

Correlations

This is interesting for hedge fund investors, who might be eyeing correlations between underlying funds and strategies they invest in.

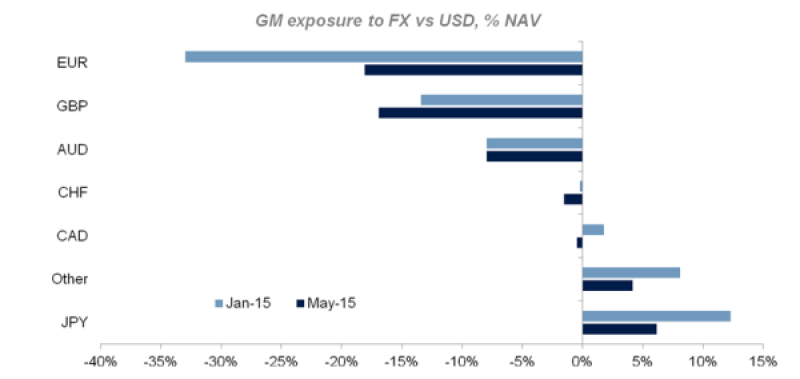

Ferreira says: “Discretionary macro managers often have very different exposures to trend followers. For example, CTAs are net short commodities, while discretionary managers are net long.

“But in recent months their positioning in FX has been very similar, though discretionary managers have tended to be less aggressive. There is broad consensus in the FX markets.”

That consensus has seen macro managers gravitate to short positions in euro, yen and sterling, while it is increasingly difficult to avoid being long the dollar.

QCM’s Karim says: “It is a logical trade. You have the US, a safe haven, the strongest economy, with rate-hike prospect. And you have political and economic trouble in Europe with a slow economy. The contrast is huge and it forces you to back the dollar.”

However, as popular as it is, it is not the only game in town.

“Some managers are active in emerging markets (EM), especially the more liquid currencies, such as the Mexican peso, Turkish lira, Korean won and South African rand,” says Lyxor’s Ferreira.

“But these are minor exposures for large macro players compared to their trades on mainstream currencies. EM FX exposures only tend to be more significant in the portfolios of smaller, specialist FX managers, rather than the large global macro players.”

Hence the interest in pure currency funds, which will be better placed to go after the less obvious, less-liquid opportunities. It might also be harder to trade profitably than it once was, meaning there is arguably some value in having a dedicated fund, focused on currencies and without the distractions of other asset classes in the portfolio.

Central bank intervention might be keeping some hedge fund managers on the sidelines of FX by disconnecting market moves from traditional drivers such as inflation, growth and trade data. Though it is interesting to note that, anecdotally, hedge funds appear to have come through one high-profile example of central bank intervention relatively unscathed.

|

Pacome Breton, |

“From our point of view, not many hedge funds were caught out by the Swiss franc move in January, because the risk-return of the trade was not highly attractive,” says Breton at FQS. “There were blow-ups, for example Everest, but most macro funds had very marginal positions.” Still, this does not detract from the point that currency traders have more to think about today than they have done.

Karim says: “In the past, trading currencies was relatively simple. You looked at a few factors, such as growth, inflation and trading statistics, you had a model in your head or a computer model and you made a trade.

“Today, with central bank intervention and single currencies such as the euro there are so many more influences at play, it is much harder to know how important any one factor is at any time.”

Still, FX remains an attractive asset class for managers to hold in a diversified portfolio, he says.

“FX is a great diversifier because there is no beta in it,” says Karim. “You can’t hold it and get paid like you can from the dividend in a stock or the interest in a bond. So it presents great trading opportunities.

“It would be unwise of a macro manager not to trade FX.”

|

|

Source: Lyxor |