The euro is likely to weaken versus the counter-cyclical US dollar and Japanese yen but may appreciate against all other pro-cyclical currencies, and in particular, eastern European currencies, as eurozone repatriation accelerates and the market increasingly prices in a global economic slowdown.

| Exports to Eurozone as % of GDP |

|

| Source: Deutsche Bank |

At the top of the table stands the Czech Republic and Hungary, two of the most exposed countries to a euro-area downturn, with eurozone exports accounting for over 40% of GDP. A growth slowdown would first affect Eastern Europe, followed by developed European economies and then Asia, says Saravelos.

“With the euro being a counter-cyclical currency, and most of these regions having benefited from capital inflows from Europe, the currencies at the top of those rankings should weaken versus the euro,” says Saravalos.

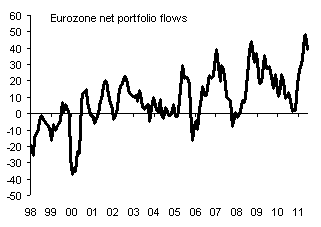

Indeed, Deutsche Bank’s data shows that the dynamic may already be in play, with European investors already repatriating capital, leading to a boom in net portfolio inflows, a dynamic which runs counter intuitively to what one would expect, adds Saravalos .

|

| Source: Deutsche Bank |

The US and Japan, on the other hand, would be the least affected with exports to the eurozone accounting for a small fraction of total GDP. The dollar and yen will also benefit heavily from capital repatriation as the global growth outlook deteriorates. Saravalos is advising investors to stay short EURUSD and EURJPY while going long euros versus the Scandinavian, Eastern European, and Asian currencies.